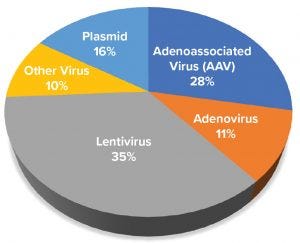

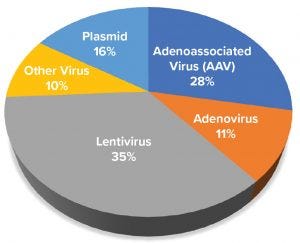

Figure 1: Distribution of gene-based advanced therapy medicinal products in development based on viral or plasmid platform used to express gene of interest

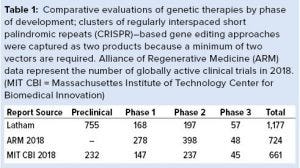

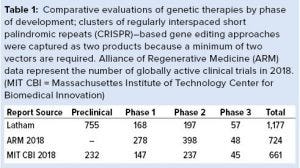

Advanced therapy medicinal products (ATMPs) are engineered to replace defective, disease-causing genes to compensate directly for a genetic defect or to encode a therapeutic protein construct (e.g., chimeric antigen receptor, CAR) for disease treatment. In most instances, a viral vector delivers the engineered genetic payload, targeting cells in situ or ex vivo through cellular modification, expansion, and infusion into a patient. Clinical successes of ATMPs bolstered by regulatory approval of products such as Luxturna (voretigene neparvovec-rzyl, Spark Therapeutics), Kymriah (tisagenlecleucel, Novartis), and Yescarta (axicabtagene ciloleucel, Kite, a Gilead Company) have dramatically increased funding and new-company formation. According to the Alliance for Regenerative Medicine (ARM), more than 700 active gene and gene-modified cell therapy clinical trials are ongoing globally (Table 1). A surge in demand for viral vector manufacturing has been driven by a swelling of new product candidates pushing to enter clinical development and an increasing number of candidates needing 100-fold or more clinical vector for diseases requiring systemic administration (e.g., hemophilia and muscular dystrophies).

Contract development and manufacturing organizations (CDMOs) and academic vector cores primarily have manufactured viral vectors for clinical vector supply. The increasing demand for viral vectors has created a bottleneck effect, impeding clinical advancement of such products (1). CDMOs have responded by building additional capacity, and some companies are building internal manufacturing capacity. To understand better whether CDMO capacity is keeping pace with clinical viral vector demand, we built a model to forecast the quantity of viral vectors required to support ongoing and planned clinical trials. The projected vector requirements were compared with the CDMO manufacturing capacity available over time. Our analysis focused on adenoassociated virus (AAV) and lentivirus/retroviral vectors and took into consideration the ranges of vector product yield, potential batch sizes, vector requirements for disease/product type, target organs, number of trials, and patient enrollment. The results suggest that viral vector demand will exceed CDMO manufacturing capacity by Q1 2020.

ATMP Vectors and Manufacturing Platforms

More than 400 ATMPs have entered into clinical development, with most genetically based programs using adenoassociated virus (AAV) and lentiviral vectors for different indications, including cancer, Parkinson’s disease, spinal muscular atrophy and multiple ocular disorders (2–4). These vectors long have been used for academic research and now have an established track record of clinical efficacy and safety (2, 4). They have been manufactured in human embryonic kidney 293 (HEK293) cells using transient plasmid transfection (5, 6). AAV vectors also are being produced using insect cells through recombinant baculovirus infection (7, 8).

Most viral vector manufacturing approaches for initial clinical use were developed in academic settings. These strategies relied on AAV and lentiviral vectors produced in small-scale two-dimensional (2D) adherent HEK293 cell culture systems. To supply enough vectors for advanced stages of clinical development and commercial operations, such processes must be scaled up. Scale-up of adherent culture systems can be problematic, so alternative suspension-based, stirred-tank bioreactor production strategies have been developed. Such innovations include three-dimensional (3D) fixed-bed bioreactor technology to bolster adherent cell production, baculovirus-driven insect-cell manufacture for AAV, and clonal isolation of suspension HEK293 cell lines (6, 9, 10).

Methods

Our goal was to generate a comprehensive and data-based model to project viral vector manufacturing needs and corresponding production capacity at CDMOs. We studied

landscape assessment for the types of products in development

annual patient-load for phase 1–3 clinical trials per trial

vector requirements for specific therapies, their target organs, and vector quantities required to enroll and treat patients in individual clinical trials

vector yields across platforms

estimates of batch capacity, annual throughput, and production scale at CDMOs and academic cores for vector manufacturing

assessment of the growth of cell and gene therapy clinical trials.

To estimate current and future AAV and lentiviral vector demand, databases that captured information about ATMP clinical trials and products in development were queried. That allowed us to create data sets that were independently reviewed to ensure accuracy. Vector yields across different manufacturing formats (e.g., suspension, adherent cells, and cell substrates for AAV vectors) were determined from a combination of primary interview research and reported literature values. Vector requirements to support clinical development were estimated based on data completed and ongoing clinical trials along with vector doses reported from multiple clinical trials across four prevalent target indications: ocular diseases, neurological diseases, hemophilia, and muscular dystrophies.

Primary research into current and future capacity of AAV and lentiviral manufacturing capacity consisted of interviews with key individuals at CDMOs and leaders at innovator companies developing ATMPs. CDMO interviews focused on the capabilities for AAV and lentivirus vector current good manufacturing practice (CGMP) manufacturing and expansion plans. Interviews with innovator companies centered on their approach to viral vector manufacturing outsourcing and vector requirements for clinical development and commercial launch. To bolster and broaden the manufacturing capacity dataset for organizations in which information could not be captured from an interview, public press releases and websites were reviewed for existing capabilities and announced expansion plans based on bioreactor capacity. Those data were cross-referenced with the number of programs and batch estimates. If primary data were unavailable, then batch capabilities were assumed to be the average of available information. Finally, two sets of assumptions for expansion plans were used to estimate capacity growth: no growth after expansion plans were complete or linear growth based on the same rate as the expansion plans.

Vector Demand and Forecasting

The primary dataset for generating both current and forecasted demand originated from extracted clinical-trials data based on therapy and keyword searches between 2010 and 2018. Those searches yielded 852 results, which we pared down by removing clinical trials with missing information (e.g., start dates, end dates, and number of planned patients) as well as those for therapies that were out of the scope of our analysis (e.g., plasmid DNA-based therapies and monoclonal antibody therapies).

We generated a vector per clinical-trial patient for each target organ and indication by estimating viral vector requirements for active trials of similar, representative indications. By cross-referencing the vector per patient with the trials’ planned patients, the total number of vectors could be estimated for each trial. We averaged the total over each trial’s duration while summing the number of vectors used in all trials per year. We completed this assessment for all ongoing and planned clinical trials to develop an overall annual market demand.

Results

Gene Therapy Landscape: To build a model of viral vector demand and capacity for ATMPs, we examined the overall landscape of products that could be defined as genetic therapies. Our analysis focused on companies and products in development (excluding those at academic laboratories) identified through public databases and a subscription database (GlobalData). Products focused on viral vectors and included plasmid DNA products but excluded synthetic RNA-based approaches to make the overall landscape comparable with other landscape analyses. Then we verified the products in development by reviewing individual company website information to verify and quantify the product candidates and their stage of development. The output of our internal analysis identified more than 1,100 product candidates in development globally (Table 1). Our independently generated data were compared with other publicly available 2018 year-end reports (ARM and the Massachusetts Institute of Technology Center of Biomedical Innovation, MIT CBI). In general, our data on the number of clinical product candidates and active clinical trials aligned with results from the other two studies, but we saw a divergence in the number of preclinical candidates (Table 1).

Figure 1 shows the distribution of products in development based on viral vector type. Most products in development use a lentivirus and gamma retrovirus vector, with AAV and plasmid-based approaches being the next most common. Lentiviral vectors predominantly are used for generating chimeric antigen receptor (CAR) T cells and T-cell receptor (TCR) approaches to combat liquid and solid tumors in immunooncology. AAV vectors are used almost exclusively for gene therapies that supply functional copies of genes or to correct defective, disease-causing genes in a patient.

Our study found that plasmids are used in three ways: vaccines, alternative approaches to engineer CAR T-cells, and a directly administered gene therapy. Many adenovirus and “other” viral vectors (representing over 20% in Figure 1) are used as oncolytic viruses and in vaccines to express target antigens against pathogens or tumor targets. Collectively, these data reveal an expansive pipeline of product candidates in and entering clinical development, all of which will require CGMP manufacturing.

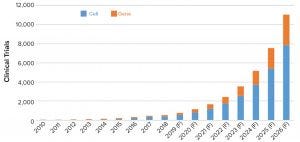

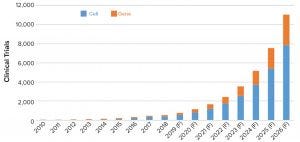

Figure 2: Historical and forecasted (F) number of clinical trials for cell and gene therapies

Development of Viral Vector Demand Forecast: Multiple variables must be determined to forecast viral vector demand and capacity for ATMPs. These variables include the projection of the number of clinical trials, patient enrollment in those trials, and viral vector requirements to fulfill the trials. A forecast also requires information about AAV and lentiviral vector manufacturing yields and platforms in use to determine manufacturing capacity required to fulfill vector demand.

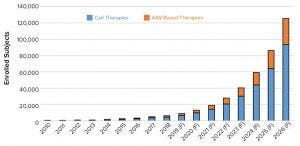

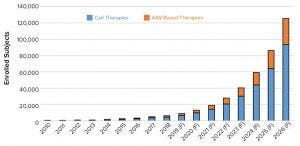

Figure 3: Historical and forecasted (F) patient enrollment in cell and gene therapy clinical trials

The first step in that process was to generate a dataset of clinical trials using AAV and lentiviral vectors. We built the initial dataset comprising more than 800 active and completed clinical trials starting from 2008 and continuing through 2018. Those trials were reviewed for appropriateness based on the vector (AAV or lentivirus/CAR-T). We calculated compound annual growth rates (CAGRs) based on historical growth rates of clinical trials as well as numbers of trial patients, required vectors, and required batches. We extracted reported CAGRs from published market reports of the growth of the cell and gene therapy sector. Using an overall average CAGR, we projected the growth in the number of clinical trials and patient enrollment over the next eight years (2019–2026) (Figures 2 and 3).

Based on the calculations of current growth rates, we anticipate the number of clinical trials to rise from about 775 trials forecasted to be ongoing in 2019 to nearly 11,000 active trials by 2026. For clarity, that is the number of active trials based on historical trial duration of the ATMP sector and not only newly initiated trials per year. Consistent with the product types in development, products in most trials to be conducted and for patient enrollment are based on cell and gene therapies (for immunooncology) rather than AAV vectors. The projected number of trials in 2026 represents only about 10% of the total active clinical trials in 2018. Because all registered clinical trials overall also are expected to grow, that comparison provides rationale to the projected trials and enrolled subjects.

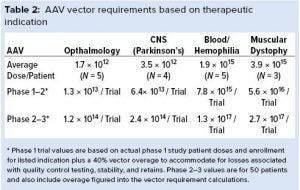

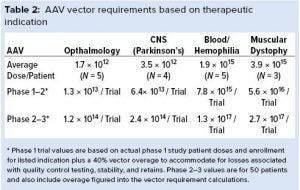

Once we projected the number of trials and subjects, we estimated the volume required to fulfill enrollment projections and support program sampling and stability studies. Doing so entailed determining the range of AAV and lentiviral vector requirements and estimating the number of production batches based on yield information provided from both primary and secondary sources. For AAV programs, we estimated average vector doses using information from the US National Library of Medicine’s clinicaltrials.gov across four major diseases and the route of administration (local and systemic) (Table 2). Our analysis shows a stark contrast in AAV vector requirements on a per-subject basis when comparing a locally administered vector for ocular diseases with a systemically administered vector for muscular dystrophies (about 2,300-fold).

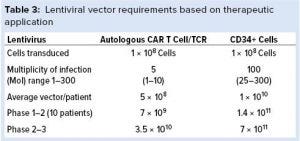

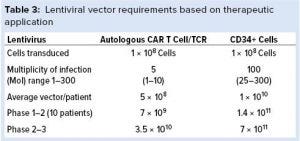

We performed similar calculations for lentivirus transduction strategies for both T-cell and CD34+ in vitro approaches (Table 3). For both modalities, the target number of cells to be transduced was the same, but the reported ranges in the number of virus particles per cell required for transduction were different (11–14). For modeling purposes, we used a multiplicity of infection (MoI): five for CAR applications and 100 for CD34+ cell transduction. In vitro transduction minimizes vector requirements, but batch yields of lentivirus production are lower and more variable, with reported yields ranging from 4 1010 to 1 1012 infectious units per batch (depending on scale capabilities of a production facility and analytical method for quantitation).

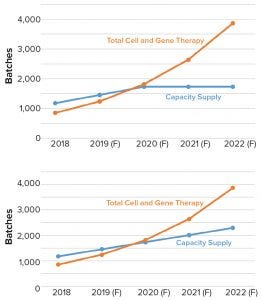

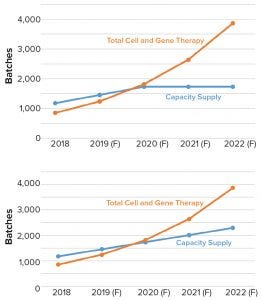

Figure 4: Comparing clinical viral vector manufacturing capacity (blue) with demand (orange); (top) model output for outsourced viral vector manufacturing capacity and clinical vector demand for a scenario in which no additional manufacturing capacity beyond what is planned comes on-line; (bottom) model output when manufacturing capacity expansion continues and comes on-line at a steady rate (F = forecasted)

AAV batch yields vary based on capsid serotype, gene to be packaged, and production platform. For our modeling exercise, we assumed that strategies requiring a low number of vectors (1 × 1015 vector genomes per batch) would use adherent HEK293 platforms, and products requiring high-level, systemic administration would be produced in suspension (using baculovirus or comparably producing HEK293 cell line) at 2,000-L scale with a yield of 1 × 1015 vector genomes per batch (9, 10). We also assumed that future distribution of products in development would be consistent with those in 2018. From discussions with viral vector CDMOs, academic vector cores, and information about the number of manufacturing suites, we projected fermentation scale capabilities and expansion plans to estimate the number of viral vector batches that could be manufactured each year. That information was used to generate a viral vector capacity and demand model (Figure 4).

Projected Demand

Projected Demand

Our analysis demonstrates that the projected demand for manufacturing of AAV and lentiviral vectors will surpass available CDMO manufacturing capacity in 2020, even with the surge in planned CDMO expansions to come on-line from 2018 to 2020 (Figure 4 top). Results also showed that additional manufacturing capacity expansion at the same rate will not compensate for the growing clinical manufacturing demand (Figure 4 bottom). If our projections are accurate, the number of potential batches needed to fulfill clinical demand will be over twofold higher than the capacity to produce them. Also important, based on discussions with CDMOs, is that <10% of their customers have plans to construct their own manufacturing facilities. Instead, most innovators intend to outsource viral vector manufacturing. Even companies that have built or are planning to build internal manufacturing capacity are likely to outsource services that support either a portion of commercial manufacturing or pipeline products advancing to clinical trials.

Other variables could be incorporated into future iterations of our model that could affect projected viral vector demand and capacity. Such parameters could include further expansion and implementation of nonviral transduction for genetic alterations (e.g., Sleeping Beauty transposons), improved vector transduction efficiencies resulting in lower clinical vector requirements, improved cellular production strategies (resulting in log improvements in vector yield per batch), and new CDMO entrants into the viral vector manufacturing space to add additional capacity; and a further shift by ATMP developers to build their own viral vector manufacturing capacity.

Recent approvals of ATMP products such as Zolgensma (onasemnogene abeparvovec-xioi, AveXis) have provided a pathway for rapid clinical advancement to licensure for treatment of rare diseases. That puts a greater emphasis on chemistry, manufacturing, and controls (CMC) as well as manufacturing process robustness, characterization, and subsequent validation to ensure product consistency. Thus, innovator companies should define their manufacturing strategies early in development and identify suitable CDMO partners to accommodate near-term and long-term manufacturing needs. Another future complicating factor that we did not account for in our model was the impact of commercial product manufacturing. A significant portion of recent CDMO capacity expansion was made to support phase 3 and commercial product manufacture, which will further reduce capacity surrounding clinical vector supply. Given the above circumstances of projected demand, newer CDMO partnering strategies beyond a traditional “project” or “single campaign strategy” might need to be considered to enable flexible or “on-demand” manufacturing to achieve product development success.

Recent approvals of ATMP products such as Zolgensma (onasemnogene abeparvovec-xioi, AveXis) have provided a pathway for rapid clinical advancement to licensure for treatment of rare diseases. That puts a greater emphasis on chemistry, manufacturing, and controls (CMC) as well as manufacturing process robustness, characterization, and subsequent validation to ensure product consistency. Thus, innovator companies should define their manufacturing strategies early in development and identify suitable CDMO partners to accommodate near-term and long-term manufacturing needs. Another future complicating factor that we did not account for in our model was the impact of commercial product manufacturing. A significant portion of recent CDMO capacity expansion was made to support phase 3 and commercial product manufacture, which will further reduce capacity surrounding clinical vector supply. Given the above circumstances of projected demand, newer CDMO partnering strategies beyond a traditional “project” or “single campaign strategy” might need to be considered to enable flexible or “on-demand” manufacturing to achieve product development success.

Multiple viral-vector–based products are in pivotal trials, with product approvals pending in the next two years. That situation is likely to fuel greater innovation and greater numbers of product candidates for clinical development. With the promise of long-term therapeutic impact, new candidates may target more chronic or age-related diseases such as wet age-related macular degeneration (AMD), Parkinson’s disease, more prevalent cancers, and cardiovascular diseases. Such targets will have even greater vector requirements to accommodate larger patient populations. Of critical importance to these potential breakthrough therapies will be the need for a defined strategic plan to manufacture and bring ATMPs into the mainstream of medical care.

Multiple viral-vector–based products are in pivotal trials, with product approvals pending in the next two years. That situation is likely to fuel greater innovation and greater numbers of product candidates for clinical development. With the promise of long-term therapeutic impact, new candidates may target more chronic or age-related diseases such as wet age-related macular degeneration (AMD), Parkinson’s disease, more prevalent cancers, and cardiovascular diseases. Such targets will have even greater vector requirements to accommodate larger patient populations. Of critical importance to these potential breakthrough therapies will be the need for a defined strategic plan to manufacture and bring ATMPs into the mainstream of medical care.

References

1 Kolata G. Gene Therapy Hits a Peculiar Roadblock: A Virus Shortage. New York Times 27 November 2017; https://www.nytimes.com/2017/11/27/health/gene-therapy-virus-shortage.html.

2 Ortolano S, Spuch C, Navarro C. Present and Future of Adeno Associated Virus Based Gene Therapy Approaches. Recent Pat. Endocr. Metab. Immune Drug Discov. 6(1): 47–66 (2012); doi:10.2174/ 187221412799015245.

3 Boráň T, et al. Clinical Development and Commercialization of Advanced Therapy Medicinal Products in the European Union: How Are the Product Pipeline and Regulatory Framework Evolving? Hum. Gene Ther. Clin. Devel. 28(3) 2017: 126–135; doi:10.1089/humc.2016.193.

4 Wilkins O, Keeler AM, Flotte TR. CAR T-Cell Therapy: Progress and Prospects. Hum. Gene Ther. Methods 28(2) 2017: 61–66; doi:10.1089/hgtb.2016.153.

5 Cecchini S, Virag T, Kotin RM. Reproducible High Yields of Recombinant Adenoassociated Virus Produced Using Invertebrate Cells in 0.02- to 200-Liter Cultures. Hum. Gene Ther. 22(8) 2011: 1021–1030.

6 Lennaertz A, et al. Viral Vector Production in the Integrity iCELLis Single-Use Fixed-Bed Bioreactor, from Bench-Scale to Industrial Scale. BMC Proc. 7(suppl 6) 2013; doi:10.1186/1753-6561-7-s6-p59.

7 Grieger JC, Samulski RJ. Adenoassociated Virus Vectorology, Manufacturing, and Clinical Applications. Methods Enzymol. 507, 2012: 229–254.

8 Urabe M, Ding C, Kotin RM. Insect Cells As a Factory to Produce Adenoassociated Virus Type 2 Vectors. Hum. Gene Ther. 13(16) 2002: 1935–1943; doi:10.1089/10430340260355347.

9 Kotin RM, Snyder RO. Manufacturing Clinical Grade Recombinant Adeno-Associated Virus Using Invertebrate Cell Lines. Hum. Gene Ther. 28(4) 2017: 350–360; doi:10.1089/hum.2017.042.

10 Grieger JC, Soltys SM, Samulski RJ. Production of Recombinant Adeno-Associated Virus Vectors Using Suspension HEK293 Cells and Continuous Harvest of Vector from the Culture Media for GMP FIX and FLT1 Clinical Vector. Mol. Ther. 24(2) 2016: 287–297; doi:10.1038/mt.2015.187.

11 Mock U, et al. Automated Manufacturing of Chimeric Antigen Receptor T Cells for Adoptive Immunotherapy Using CliniMACS Prodigy. Cytother. 18(8) 2016: 1002–1011; doi:10.1016/j.jcyt.2016.05.009.

12 Qasim W, et al. Molecular Remission of Infant B-ALL After Infusion of Universal TALEN Gene-Edited CAR T Cells. Sci. Transl. Med. 9(374) 2017: eaaj2013; doi:10.1126/scitranslmed.aaj2013.

13 Río P, et al. Engraftment and In Vivo Proliferation Advantage of Gene-Corrected Mobilized CD34+ Cells from Fanconi Anemia Patients. Blood 130(13) 2017: 1535–1542; doi:10.1182/blood-2017-03-774174.

14 Cartier N, et al. Hematopoietic Stem Cell Gene Therapy with a Lentiviral Vector in X-Linked Adrenoleukodystrophy. Science 326(5954) 2009: 818–823; doi:10.1126/science.1171242.

Corresponding author Joseph Rininger ([email protected]) is director of cell and gene therapy, Ashley Fennell is associate consultant, Lauren Schoukroun-Barnes is senior associate consultant, Christopher Peterson is senior consultant, and Joshua Speidel is managing director, all at Latham Biopharm Group, 101 Main Street, Suite 1400, Cambridge, MA 02142.