The first article in this periodic series reviewed the impact of cost pressures on the biopharmaceutical industry, in particular the challenges the industry faces in relation to high capital costs, complex processes, and long product development cycles (1). Here we examine what companies are doing to assess costs in decisions about process and technology choices relating to manufacturing of biologic drug substances. We will look into what companies are currently doing and what they need to be doing to control costs. Companies need to know from a strategic perspective how technology and process choices influence manufacturing costs within a portfolio of products; the type and timing of investments required to ensure sufficient manufacturing capacity; and how an understanding of costs can optimize risk management.

Process development can be defined as the start of the product life cycle. At this stage a manufacturing process is defined in terms of unit operations (discrete manufacturing operations). There are significant pressures to be fast (not on the critical path of a clinical program) and reduce the cost of development. Cost pressures are related to clinical risk insofar as a product entering clinical trials is highly unlikely to reach approved status (high attrition rate). Consequently, there is no incentive to put a lot of effort into developing an efficient process early on. With respect to product lifecycle, the clear message is that as a product moves from research into manufacturing, the scope for improving manufacturing cost effectiveness diminishes. Many people in the industry, however, are realizing that in addition to characterization and forced degradation studies, cost optimization should be factored if we are to maximize the opportunity to develop cost-effective robust processes. The later stages of the product lifecycle are more about efficient operation of facilities (Table 1).

Table 1: CoG model appliations

Table 1: CoG model appliations ()

How Is Cost of Goods Measured?

Most cost models draw on the principles of financial and management accounting to assess the cost impact of different investment and operating decisions. Of the various methodologies (net present value [NPV] and return on investment [ROI]), cost of goods (CoG) is by far the methodology most commonly used. Although not the most rigorous, it does have the merit that most people in the industry understand this approach. CoG should not be used when you need to understand the interplay between expenditures, timing, and project risk. NPV or ROI methodologies are better techniques for analyzing alternative technologies and manufacturing strategies because they can account for the impact of delays in expenditures and properly account for the time value of money.

For manufacturing, the most significant line item on an income statement is the cost of producing goods for sale (i.e., cost of goods sold or cost of sales), which is shown directly below net sales revenue. Subtracting that cost from the sales revenue results in a company’s gross profit, which is an important measure of operating performance. By separating the direct costs involved in producing goods for sale from other expenses (e.g., selling, general, and administrative [SG&A] expenses; research and development [R&D] expenses; interest and taxes), a company can evaluate manufacturing performance as a distinct measure that contributes to overall business performance.

A robust, well-structured cost model enables managers to have a better insight into key cost drivers of a biomanufacturing process as well as the sensitivity of overall CoG to changes in key parameters. These models enable the cost impact of implementing various technologies to be evaluated (as well as the effect of process changes such as increasing product titers and yields) and can be validated with financial accounting data. Some management accounting techniques such as life-cycle cost analysis and activity-based costing are also incorporated into manufacturing cost models in recognition of the significant effect manufacturing efficiency has on the average CoG. In particular, the number of successful production runs per year and the cost of facility downtime and batch failure often have a much greater effect on overall manufacturing costs than changes in raw material or labor costs.

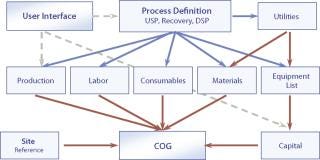

To illustrate this approach, we examine a modular approach initiated at BioPharm Software Solutions (a business unit of Biopharm Services Ltd.). The cost model is configured as modules (e.g., capital, materials, consumables, labor) that show the relationships among the various cost categories and the cost components that constitute the overall CoG (Figure 1). This methodology has the advantage of being scalable, flexible, user-friendly, and transparent.

Figure 1: ()

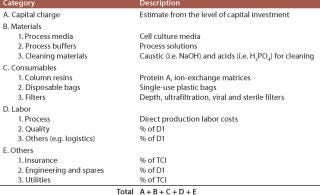

CoG is a fairer comparison than capital cost because it accounts for all differences in facility throughput, material costs, labor costs, and so forth. The indirect (fixed) cost consists of the capital charges, insurance and taxes, and the direct (variable) costs include consumables, materials, and labor. Table 2 shows the component items that contribute each cost category (e.g., the consumables class includes column gels, filters, and single-use bags).

Table 2: Typical cost categories

Table 2: Typical cost categories ()

What Is Done Currently?

Biopharm Services has conducted cost modeling work for more than a decade and has developed hundreds of cost models with manufacturers, technology developers, and suppliers. Taking into account the manner in which biopharmaceutical companies’ internal cost evaluations have been developed to date, we can make the following general observations:

There is no consistent definition of what constitutes CoG in terms of methodology and boundaries (what’s included and what’s not). Indeed, many organizations will have various groups working independently on CoG models using completely different and incompatible methodologies.

The source of cost data is not often shared among all users.

Finance departments are not always involved, and as a consequence they are unable to buy into the outcome.

Models are often custom built, not properly validated, and properly understood only by their developers. This can cause problems when it comes to supporting the models if, for example, their original developer changes roles or leaves. These internal custom models often take months or years to develop.

The models are often inflexible and geared to looking at a specific set of scenarios, making them difficult to reconfigure.

A PERSPECTIVE ON COST MODELING

To get an external perspective, we talked to Richard Francis, who until recently headed the process development function at BTG. Richard has worked in senior positions in process development for companies such as Centocor, GSK, and Celltech. He provides a broad industrial perspective, having been involved in taking eight biopharmaceutial products to market and in the development of others that didn’t make it. He now heads up his own company, Francis Biopharma.

“In my experience, different companies’ attitudes to cost modeling vary considerably for not looking at production costs until after product approval. This late evaluation of cost has led to issues where, in one extreme case, a company’s production costs exceeded the sales price. It’s a mixed picture at the moment, but there is an increasing awareness of costs in the industry. I believe it’s important that manufacturing cost be evaluated and considered from the initial process conception stages onward and given an equal weighting alongside product quality and safety. Development of a cost-effective process that consistently yields a safe product meeting predetermined quality standards is the goal. From a process development perspective, a detailed understanding of cost in association with potential process risk factors is a must-have map to help guide later stages of development. This is as important for the small- to medium-size companies that are planning to or considering licensing out their products. The companies doing in-licensing are more sophisticated these days, and in addition to market potential, they are looking at cost of manufacture and supply-chain risk when licensing in as a part of the due diligence exercise.

“Today the goal has to be to develop cost-effective processes. So as part of the process development activities, it is key to evaluate alternative technologies very early on, evaluating options such as expression systems and product capture methods (chromatography or precipitation). These choices are unavailable later on. In an ideal process development world, suitable small-scale process models would be developed initially to feed data into process modeling software to map out the process and scale up the operation in silico to evaluate costs and fit with existing manufacturing platforms (if applicable). This approach then yields a rationale for selection of a particular technology or processing platform, which is invaluable historical data when trying to justify the selection to regulatory agencies or during a due diligence effort if the product or process is being offered for sale.

“This way, you are developing business cases to support new investments, effectively presenting the data set in a language senior management can appreciate and emphasize with (e.g., CoG will be, capital expenditure could be, and the risk factors and benefits are so much easier when all possibilities are modeled out), and the rationale for selecting a defined set of process conditions and equipment is explained and justified both scientifically and financially.”

What Is Required?

Clearly, understanding the cost of manufacturing drug substance and those factors that influence manufacturing costs during development of a drug candidate is important to the future of the industry if it is to remain both profitable and successful. To date, the development and use of cost models within organizations has largely been carried out by individual champions in various parts of an organization rather than as an integral part of product strategy. This has led to problems in making meaningful comparisons within organizations, obtaining group support for using process CoG models, and getting the necessary buy-in to establish a consensus for decision making. This has limited the use of process modeling in decision making, evaluation, and directing development.

To some extent these problems have arisen because, until recently, there have been no CoG analysis products available to companies from third-party vendors that are both simple to use and geared to the requirements of biopharmaceuticals. To be useful, a CoG model package must be deployable across an organization and meet the requirements of different users. Therefore, the boundaries can be defined, consistent methods can be implemented, and common standard cost data can be used. If organizations can achieve that, then they will maximize their opportunities to drive out costs early in development with little effort, thus leveraging their limited resources.

About the Author

Author Details

Corresponding author Andrew SInclair is the founder and president of Biopharm Services Ltd., Lancer House, East Street, Chesham HPS 1RD, United Kingdom; 44-14947-932-43, [email protected]. Miriam Monge is vice president of marketing and disposables implementation at Biopharm Services Ltd.; [email protected].

REFERENCES

1.) Sinclair, A, and M. Monge. 2010. Delivering Affordable Biologics from Gene to Vial. BioProcess Intl. 8:16-19.