HTTPS://WWW.ISTOCKPHOTO.COM

The biopharmaceutical industry is at the forefront of technological advancements, with “biopharma 4.0” revolutionizing the way biomanufacturing is conducted (1). The concept combines automation, artificial intelligence, data analytics, and real-time monitoring to enhance efficiency, flexibility, and quality in bioprocessing (2). However, such rapid evolution has given rise to a significant skills gap, with the existing workforce lacking competencies needed to leverage the full potential of this transformative paradigm (3, 4). In this two-part report, we explore the key expertise required for the transition and the resulting skills gaps, with discussion of strategies for addressing these talent challenges.

Biopharma 4.0 demands a new set of skills and expertise to harness the power of digitization and automation most effectively (5, 6). Key needs include experience with data analysis, machine learning (ML), process optimization, and cybersecurity — in addition to advanced knowledge of complex bioprocessing technologies. Biopharmaceutical professionals also must possess adaptability, critical-thinking skills, and problem-solving abilities to navigate the rapidly evolving landscape of biopharma 4.0 (7, 8). This new era brings tremendous opportunities for increased productivity, efficiency, and innovation in drug development and biomanufacturing (9). However, as the industry rapidly evolves, it faces unique challenges in acquiring and developing the talent needed to harness the potential of biopharma 4.0 (10, 11).

Biopharma 4.0 encompasses a breadth of technological innovations such as artificial intelligence (AI), ML, big-data analytics, robotics, and advanced manufacturing techniques (12, 13). To bridge the associated skills gap, the industry first must identify core competencies required for biopharma 4.0 (14). With digital fluency, professionals possess a strong foundation toward digital literacy, including proficiency in data analysis, cloud computing, and cybersecurity (15, 16). Familiarity with data integration, management, and interpretation is crucial for harnessing the power of digital technologies in bioprocessing (17).

Similarly, competency in data analytics includes the ability to analyze and derive meaningful insights from large data sets — a key skill in biopharma 4.0. Professionals should be adept at using advanced analytics tools, predictive modeling techniques, and data visualization to optimize processes, improve decision-making, and drive innovation (5, 18). Automation and robotics functions as another competency for biopharma 4.0, which relies on such technologies to enhance operational efficiency, accuracy, and scalability. Professionals should be equipped with the knowledge of programming, operating, and maintaining automated systems in addition to the ability to integrate them seamlessly into bioprocessing workflows (17, 19).

Regulatory compliance is a competency in itself because adhering to guidelines and maintaining compliance are critical in the biopharmaceutical industry. Professionals should be well-versed in regulatory requirements related to data integrity, cybersecurity, quality control (QC), and good manufacturing practices (GMPs) in the context of biopharma 4.0 (3). Finally, life-science professionals must possess an agile mindset because biopharma 4.0 is characterized by rapid technological advancements. Professionals should be able to embrace change and continuous learning. The ability to adapt quickly to new tools, methodologies, and industry trends is essential for success in this dynamic landscape (20, 17).

Supply and Demand: As the industry rides the transformative wave of biopharma 4.0, it faces a critical challenge in the associated skills gap (21). The demand for talent equipped with the necessary skills to navigate the complexities of biopharma 4.0 far exceeds the current supply (22). This gap can be attributed to several factors. First, the swift pace of technological advancements has outpaced development of relevant educational programs and training initiatives, leaving a void in skills acquisition for rapid technological advancements (23). Second, the disconnect between academia and industry hampers timely development of curricula and training programs that align with the evolving demands of biopharma 4.0, described herein as limited integration of academia and industry (24, 25). Finally, resistance to change slows the adoption of new technologies and processes within many organizations, impeding the acquisition of necessary skills and hindering the implementation of biopharma 4.0 initiatives (10).

Collaboration between industry and academia will be crucial to bridging the skills gap. Industry experts can contribute to curriculum development, ensuring that educational programs incorporate biopharma 4.0 concepts, practical training, and internships. Such collaboration can facilitate the transfer of knowledge and help to ensure that graduates will be equipped with the relevant skills (26, 27).

Herein we describe a multifaceted approach to bridging the biopharma 4.0 skills gap. First, employers should invest in comprehensive training and upskilling programs to equip the workforce with biopharma 4.0 competencies. Such programs can range from workshops and seminars to certifications and online courses. Encouraging employees to take part in continuous learning opportunities can enhance their skills and keep them up to date with the latest industry trends (28). Biopharmaceutical companies also should invest in comprehensive professional development programs to enhance workforce skills. Those programs could include targeted training programs, workshops, and certifications to upskill employees in areas such as data analytics, automation, and regulatory compliance (28).

Employers also would benefit from adopting innovative recruitment strategies to attract talent with biopharma 4.0 skills. That might involve partnering with specialized recruitment agencies. Additional strategies could include proactive talent sourcing, in which bold and enterprising organizations recognize and acquire talent with the adequate skill sets for industry 4.0. Companies can leverage online platforms, professional networks, and partnerships with educational institutions to connect with potential candidates (29). Skills assessments and gap analyses are crucial to helping each organization understand its specific requirements and enabling development for targeted training programs and recruitment strategies to address those gaps (30). To bridge the skills gap and prepare existing employees for industry 4.0, organizations should invest in upskilling and reskilling programs (31, 28). Such initiatives include training workshops, online courses, mentorship programs, and certifications to enhance employee knowledge and capabilities. Companies should highlight their commitment to technology advancements, innovation, career development opportunities, and a supportive work culture aligned with the principles of industry 4.0 (32, 33).

Finally, organizations should focus on nurturing internal talent through mentoring programs, cross-functional training, and job rotations. This approach enables employees to develop new skills, broaden their knowledge base, and contribute to diverse projects within a company. Offering financial support for further education or advanced degrees also can motivate employees to acquire specialized skills (1, 34).

In our research we have sought to define and identify the specific expertise and skills-gap requirements relevant to the biopharma 4.0 transition and to help the industry implement strategies for mitigating operational disruptions in the crucial manufacturing of drug products. To determine potential skills gaps related to bio/industry 4.0, we used the Lightcast labor analytics database to identify real-time labor-market trends and the occurrence rate for specific skill and expertise terminology, executing a customized search by applying different filters.

A skills gap is defined as the disparity between employers’ requirements for experienced talent and the expertise offered by the available workforce. In this case, demand is defined as the manifestation of a specific skill in job postings, and supply is the frequency of a skill in the workforce profiles. Thus, the skills gap manifests the contrast between demand and supply. By measuring expertise in the available biopharmaceutical talent pool against the current demand, we tested the hypothesis of a potential mismatch of skills that has yet to be addressed by academia or training providers. We can predict the requisite expertise and compare that with skill sets represented in the available talent pool by measuring the pace of adoption for specific technologies in the biomanufacturing sector (35).

That study provides a quantitative analysis of biomanufacturing skills gaps at an expertise level, illustrating the key talent dynamics identifying their correlation with the rate of industry 4.0 adoption across all bioindustries. In addition, our research provides a novel measurement of the current biopharma 4.0 talent supply. The methodology is adapted from Li et al. (3), who analyzed the data-science and statistical-tools skills gaps in today’s automotive manufacturing workforce using Emsi labor analytics. In 2015, Deloitte and The Manufacturing Institute forecasted an impending skills gap related to the introduction of smart manufacturing. Previous studies have attempted such measurement in the biopharmaceutical industry using survey tools (36), but no quantitative research has been published yet. Our research presents a comprehensive, data-based analysis of skills and domain knowledge related to biomanufacturing 4.0 in the United States.

Alternative studies that assess manufacturing skills gaps — typically related to “blue-collar” roles (37–41) — implement web-scraper technologies to collect data from labor-force websites such as LinkedIn, which provide impartial data on the general job market. Some other studies (42) use the “latent Dirichlet allocation” method for job-market data analysis. Such methods can help to identify expertise essential for jobs using data science and smart manufacturing, which are in great demand for today’s manufacturing industry.

Our current investigation was stimulated by noted limitations in the existing literature on general manufacturing skills gaps. Surveys and interviews typically are limited in structure, with predefined questions that provide a complete representation of the labor market. Published studies predominantly focus on the demand for data, discounting the skillsets offered by the current and future workforces. Additionally, we’ve found a deficit in skills-gap research covering aspects of biopharma 4.0, including automation and data science.

Purpose

Below, we begin by describing the biopharmaceutical industry’s transformative shift with the advent of industry 4.0 principles. We introduce existing key skills in the sector and the emergence of alternative skills that are required to harness the emergence of automation and digitization. And we hypothesize the skills gap as a critical challenge for which the complexities of biopharma 4.0 must be navigated to provide solutions.

The next section illustrates methods we used to determine skills gaps, primarily applying programming interfaces to the Lightcast and LinkedIn databases to categorize data by job-posting keywords. We classified and organized profile and job-posting data collected over five years, and we assessed skills development over 20 years. Data collection is ongoing to assemble up-to-date expertise, skills, and domain knowledge requirements from the Lightcast Jobs Posting Analytics (JPA) module and professional profiles data from the Lightcast Profile Data (PD) module. In addition, we’ve supplemented those data with information from LinkedIn and university databases.

Beginning here in Part 1 and concluding in Part 2, our “Results” section first provides a summary of the skills/expertise gap at macro (technology clusters) and micro (specific expertise) levels, outlining the evolution of supply and demand relevant to skills needed in the biopharmaceutical industry. The relationship between talent and job frequency in different technology clusters highlights the availability and demand for specific skills. Part 2 also includes discussion and conclusion sections to elucidate current, emerging, and future trends within biomanufacturing skills and expertise, with a summary of our research findings and their limitations.

Methodology

Here we present our methodology for identifying the disparity between the skills and expertise required by biomanufacturing-sector job postings and the relevant skills and domain knowledge reported in professional profiles by job seekers. The raw data for this study came from the JPA and PD modules of the Lightcast labor-analytics database, together with triangulation information from LinkedIn and university databases. Because no previous quantitative biomanufacturing sector analysis has been executed, we adapted and improved on an analysis framework used in the automotive industry (3). This methodology is preferred over alternative skills-gap analysis methodologies for content analysis on job-market data. Although such data-driven methods can help the industry to recognize experience required for data science and smart-manufacturing–related jobs that are in high demand, the many disadvantages of such approaches include limited accuracy, difficulties in historical data acquisition, and a hindered ability to depict correlations and limitations in the topics generated.

To determine potential skills gaps resulting from the demands of industry 4.0, we used the Lightcast labor-analytics database to identify real-time labor-market patterns as well as the occurrence rate for particular skill and expertise terminology. Applying different filters provided for a customized search. Additionally, we analyzed requirements for specific competences and sector expertise recorded in job postings. For example, biomanufacturing companies active in the data-science job market often require applicants to have experience in programming languages such as Python, structured query language (SQL), and/or R script in addition to ML knowledge.

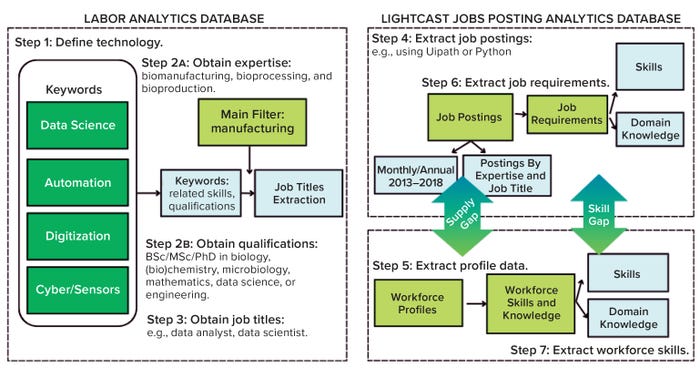

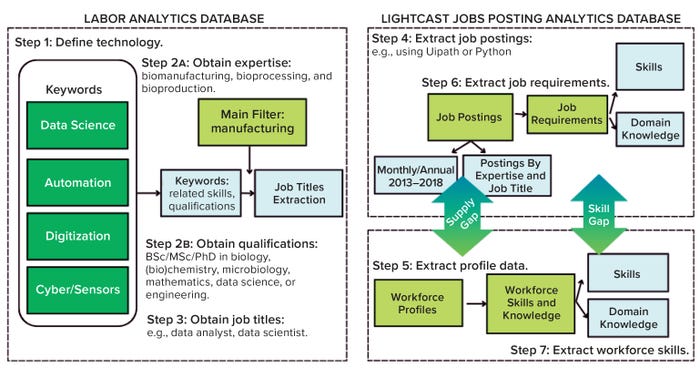

We categorized results by job-posting keyword and profile data filtered, ranked, and organized by skills, job titles, regions, and timeframes for the relevant source industries. We collected data over a five-year period (2018–2023) and assessed skills development over 20 years (2003–2023) with ongoing data collection for assembly of relevant expertise, domain knowledge, and skills requirements. As mentioned above, we used two Lightcast jobs modules supplemented by LinkedIn and university databases. Categorized data-extraction filters enabled the design of a chronological data-acquisition scheme (Figure 1).

Figure 1: Data collection and processing scheme for assessing the biopharma 4.0 skills gap.

Step 1 — Outline Technology Segments: The fourth industrial revolution (industry 4.0) originated in 2011 from a project in the high-tech strategy remit of the German government (43). It advanced the concept of cyberphysical systems (CPS) and “smart factories,” the main associated initiatives of industry 4.0. With the advent of the Internet of Things (IoT), automation, and AI, connectivity between machines became the focus of industry 4.0. By contrast, industry 5.0 will prioritize improved collaboration between humans and machines through CPS and related technologies (5).

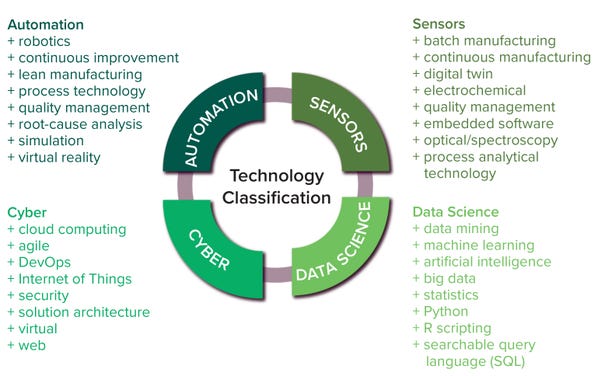

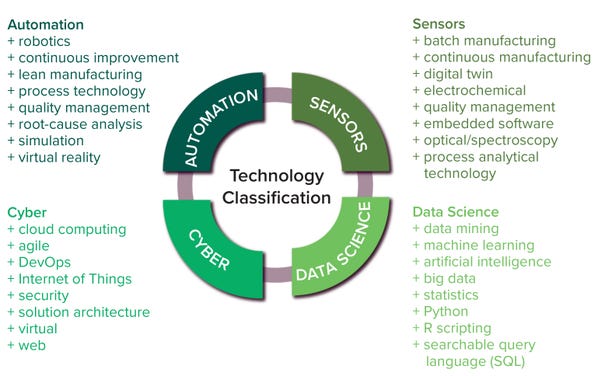

The most important constituent technologies of biopharma 4.0 are big data, the IoT, advanced processing technologies, robotics, augmented reality, simulations, CPS, cloud computing, and cybersecurity (3). As biopharma 4.0 evolves, AI is becoming more prevalent in bioprocessing to improve reliability, flexibility, and productivity in automation and big data exchange. And smart manufacturing would not be possible without sensors (44). So we segmented all these technologies into the clusters of automation, digitization, data science, cyber, and sensors — as depicted in Figure 2 — based on our own expertise and judgment.

Figure 2: Technology classification and keywords for Lightcast database searches.

Step 2 — Obtain Expertise: For each cluster, we applied the keywords of biomanufacturing, bioproduction, and bioprocess to generate data related to expertise and skills. Then we cross-reference those data in an additional industry 4.0 analysis to compare against the broader industrial sector by selecting codes 31–33 of the North American Industry Classification System (NAICS). The applied filters ensured that data gathered came from biomanufacturing companies and the biopharmaceutical industry’s talent pool.

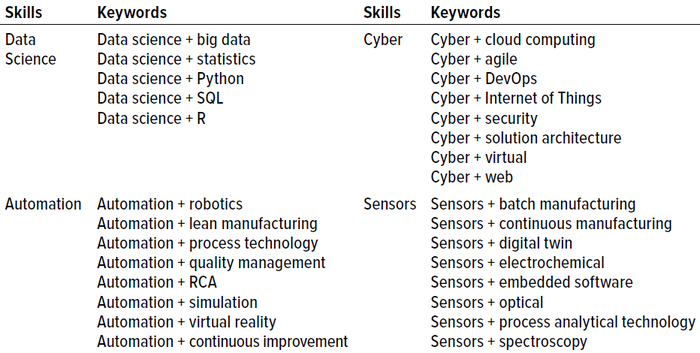

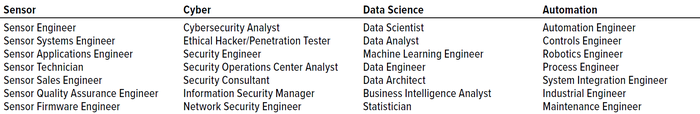

Table 1 outlines examples of biopharma 4.0 skills and expertise acquired from keyword searches. For each biomanufacturing segment, we identified particular keywords to obtain skills and expertise from the Lightcast database cross-referenced with data from LinkedIn:

• Data-science keywords include data science, data mining, big data, AI, ML, and mathematical and statistical skills (3)

• Automation keywords include automation, virtual reality, robotics, processing technology, lean manufacturing, simulation, root-cause analysis, quality management, and continuous bioprocessing (2)

• Cyber keywords include security, agile, cloud computing, IoT, virtual, web, solution architecture, and DevOps (software development and operations) — skills predominantly revolving around the IoT, cloud computing, and cybersecurity (45)

• Sensor keywords include process analytical technology (PAT), embedded software, digital twin, spectroscopy, electrochemical, optical, and both continuous and batch manufacturing — skills typically associated with signal processing and sensor analytics (3).

Table 1: Expertise in biopharma 4.0 technology segment and keywords for Lightcast database searches; SQL = structured query language, RCA = root-cause analysis, DevOps = software development and information technology (IT) operations.

Step 3 — Job Description(s) Evaluation: We collected job titles, including segment-specific skills from Step 2, and summarized them in Table 2. No titles that were presented as “<×10” in the database (2018–2023) were included in this analysis.

Table 2: Technology sector job titles.

Steps 4 and 5 — Job Postings and Profile Analysis: We analyzed job postings to conduct a gap analysis between the expertise availability (supply) and skills required (demand). Data came from 2018–2023 at both national (United States) and international (Europe, South Korea, and China) levels, as expanded upon in the Results section below and in Part 2. In addition, we also considered the geographical distribution of job postings and required educational qualifications.

Steps 6 and 7 — Job Requirements and Expertise Analysis: Expertise and skill requirements obtained included the aggregate number of job postings, significant profiles, and the most frequent skills based on their occurrence in each category. We performed a gap analysis by assessing the frequency of specific skills in the demand and supply data (see Part 2), which identified the biopharma 4.0 skills gap.

Results

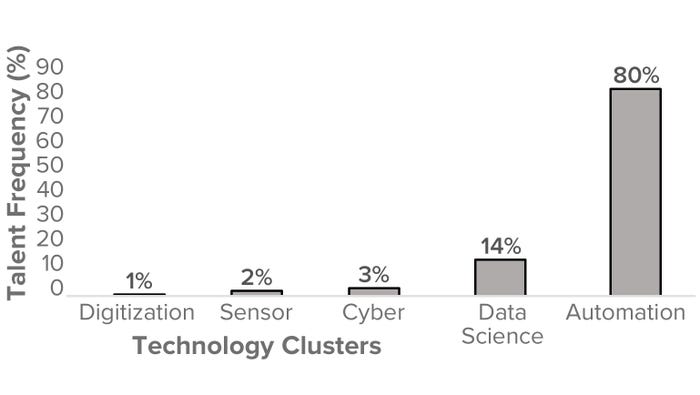

As described above, we compared the talent supply semiquantitatively with talent demand at both the macro (by technology cluster) and micro (by defined expertise) levels. Cross-referencing Lightcast database information with data from LinkedIn, we compared the biomanufacturing talent frequency across the automation, digitization, data science, cyber, and sensor technology clusters of biopharma 4.0. Together, those specific segments generally cover the key talent involved in biomanufacturing sector supported with evidence of biopharma 4.0 adoption. The talent frequency can be defined as the “available talent pool” or “2023 talent supply,” which can be compared against job postings using similar search criteria for “talent demand.” To assess identified biopharma 4.0 skills deficits, we analyzed job postings and talent profiles to conduct a gap analysis between expertise availability (supply) and skills required (demand) from data collected at both national (United States) and international (from Europe, South Korea, and China) levels from 2018 to 2023, taking the geographical distribution of job postings and required educational qualifications into consideration. Only USA data are presented herein.

Talent Supply: In cross-referencing Lightcast database information with data from LinkedIn, we compared the biomanufacturing talent frequency across the biopharma 4.0 technology clusters (technology segments) identified above. We chose those subdivisions to cover key talent involved in the biomanufacturing sector generally, supported by evidence of biopharma 4.0 adoption. We defined the talent frequency based on the available talent pool or “2023 talent supply” and compared that against job postings using similar search criteria for talent demand. These biomanufacturing sector divisions do not reflect a universal categorization.

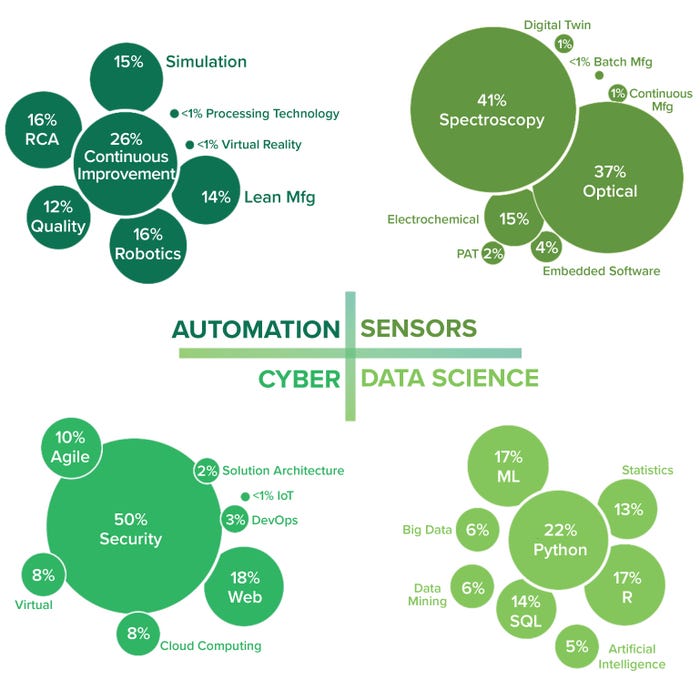

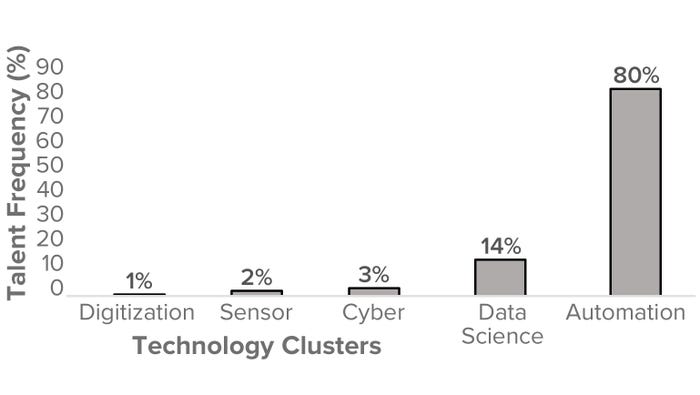

Figure 3: USA biomanufacturing talent frequency (%) by biopharmaceutical technology cluster (2023).

Our aim was to represent biopharma 4.0 themes at a macro level and thus identify and collate the talent supply from biomanufacturing companies, illustrating evidence of technology adoption as defined by the boundaries of biopharma 4.0. Figure 3 segments the frequency of biomanufacturing talent in the United States based on the biopharma 4.0 technology clusters. Note that automation has a significantly higher frequency (80%) than any other cluster, suggesting that the available biomanufacturing talent currently has more evident skills in automation than in the data science, cyber, sensor, and digitization areas.

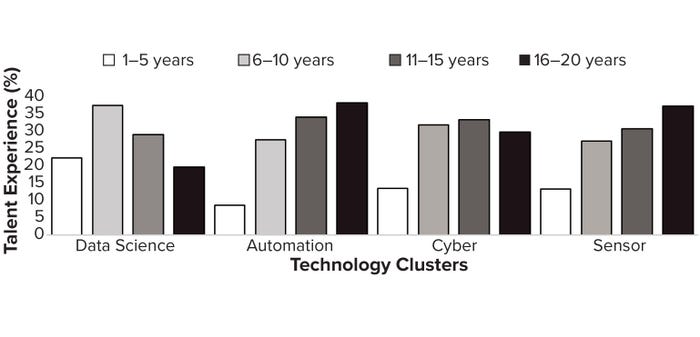

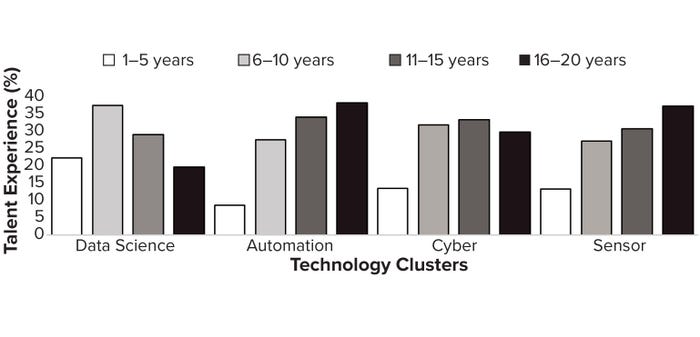

To explore the evolution of talent/expertise availability, we analyzed two decades of historic talent frequency data using the Lightcast database and cross-referencing with information from LinkedIn across the identified biopharma 4.0 technology clusters. Figure 4 clarifies that talent has matured through experience with automation — defined as an average 10–20 years of expertise per applicant (from the most recent qualification) — compared with other technology clusters with developing expertise. The cyber and sensors clusters seem to be relatively immature in expertise adoption, with only 1–5 years of experience per applicant from the most recent qualification. Note that data science is becoming more advanced, following automation, with average experience levels of 10 years from the most recent qualification. Results suggest that automation experience has evolved in correspondence with industry “on-the-job” education as biopharmaceutical technology platforms have been introduced and developed.

Figure 4: USA biomanufacturing talent experience (%) by biopharmaceutical technology cluster (2000–2023).

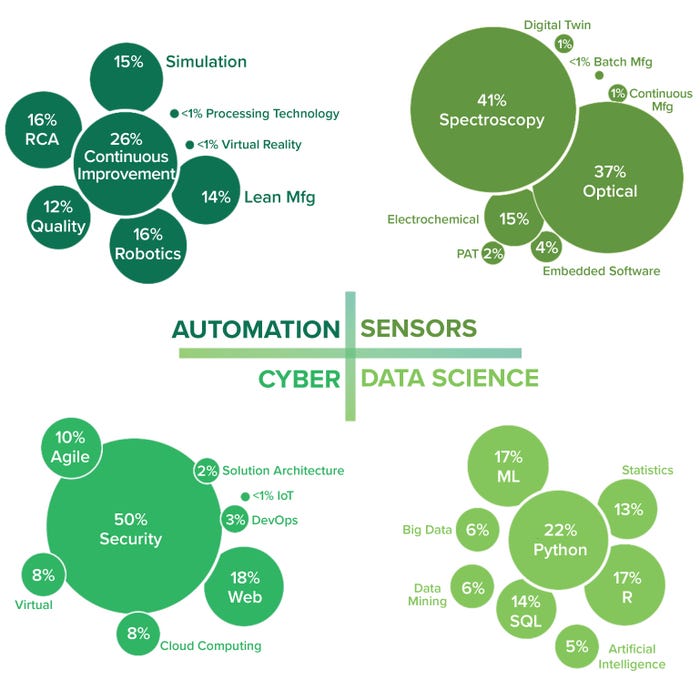

For each technology cluster, we used certain keywords to collect skills, experience, and expertise from the Lightcast database, cross-referenced with LinkedIn data. Table 1 outlines example skills and expertise acquired from our keyword searches, and Figure 5 summarizes the talent supply at a micro level, referring to the biomanufacturing employee task application.

Figure 5: Talent supply by employee task application (micro level); DevOps = software development and operations, PAT = process analytical technology, RCA = root-cause analysis, SQL = searchable query language.

Automation: This technology segment includes skills and qualifications containing the keywords of automation, virtual reality, robotics, processing technology, lean manufacturing, simulation, root cause analysis, quality management, and continuous bioprocessing (CB). The majority of the available automation talent experience (26%) is focused on CB, which is the integration of multiple unit operations in biomanufacturing into a continuous, uninterrupted process flow (Figure 5).

CB provides several advantages over traditional batch processing, including increased productivity, reduced costs, improved process control, and enhanced product quality. Implementation of CB requires a skilled workforce with specific skills to operate and optimize these advanced manufacturing systems effectively. CB skills can be further segmented into process automation and control, in which people have expertise in programming, operating process control systems, and designing control strategies. Process monitoring and analytics generates a vast amount of real-time data, including process parameters, quality attributes, and sensor measurements. Technology integration incorporates cell culture, separation, and purification processes into a seamless process flow. Quality by design (QbD), troubleshooting, process optimization, and regulatory compliance all require a strong understanding of regulatory requirements as well as knowledge of GMPs and the ability to design processes that meet regulatory expectations and ensure product safety and efficacy (46).

Note that the current lack of automation experience detected was specific to virtual reality (VR). While it has significant potential in the field of biomanufacturing, VR adoption and integration are in their early stages in the biopharmaceutical industry. However, as technology advances and VR becomes more accessible and affordable, its role is likely to expand, bringing about further advancements in process optimization, training, and research.

Data Science: This technology segment includes data science, data mining, big data, artificial intelligence, ML, and mathematical and statistical skills. Most data-science talent experience (22%) is in programming, with Python being the most common skill mentioned on LinkedIn profiles for the cluster, followed closely by R and ML (Figure 5). Python’s ease of use, extensive libraries, and active user community make it a valuable tool in biomanufacturing. Its flexibility and integration capabilities enable scientists and engineers to streamline processes, analyze data, and develop advanced models and algorithms. As biomanufacturing continues to evolve, Python is likely to play a more significant role in areas such as data analysis and visualization, process modeling and simulation, automation and control, ML and AI, laboratory automation, web applications, and data sharing.

Figure 5 shows strong automation expertise (specifically CB) in the current biomanufacturing talent field. Data-science skills include evidence of Python programming in addition to expertise in cybersecurity and optical and spectroscopy sensors. However, note the lack of detected experience with VR, AI, and digital twins, particularly a low 5% of experience in AI. With the growing rate of AI adoption in biomanufacturing, professionals who possess AI skills can bring valuable insights and contribute to process optimization and data analysis. Such skills include working with ML, data analytics, statistical modeling, and programming languages (Python and R, particularly). AI skills enable individuals to analyze large data sets, develop predictive models, implement data-driven process optimization, and extract meaningful insights from complex biomanufacturing data.

Integration of AI in biomanufacturing is likely to grow, with talent contributing to the development of smart manufacturing strategies, the implementation of real-time monitoring and control systems, and the advancement of precision techniques throughout the sector. As the intersection between biomanufacturing and AI continues to progress, individuals with a combined skill set will be highly sought after in the industry (46).

Cyber: The cyber segment includes security, cloud computing, agile, IoT, virtual, web, solution architecture, and DevOps. Such skills primarily focus on cybersecurity, IoT, and cloud computing. The largest share of cyber expertise (50%) detected among biomanufacturing employees is specific to security (Figure 5). Biomanufacturing makes cybersecurity demands for ensuring the integrity, confidentiality, and availability of sensitive data and critical processes. Challenges include intellectual property (IP) protection, data security, supply chain security, operational technology (OT) security, and regulatory compliance. OT security poses a major challenge because biomanufacturing facilities rely heavily on interconnected OT systems, including process control systems, industrial control systems, and supervisory control and data acquisition (SCADA) systems. Such equipment must be protected from cyberthreats such as malware, unauthorized access, and manipulation. Implementing network segmentation, intrusion-detection systems, and regular security assessments can mitigate potential risks (23).

Sensors: The sensor segment includes keywords such as PAT, embedded software, digital twin, spectroscopy, electrochemical, optical, CB, and batch manufacturing. These skills relate mostly to signal processing and sensor analytics. The expertise detected for optical and spectroscopy sensors is high (37% and 41%, respectively) in Figure 5.

Optical and spectroscopy sensors play a crucial role in biomanufacturing processes and use light-based techniques to analyze samples, monitor key process parameters, and ensure product quality. Common applications of optical and spectroscopy sensors in biomanufacturing include those for biomass and cell-density monitoring, pH and dissolved oxygen (DO) monitoring, metabolite and product analysis, bioreactor imaging, and PAT. The use of optical and spectroscopy sensors enables continuous monitoring, process optimization, and quality control while providing valuable insights into critical parameters that facilitate data-driven decision-making and improve process efficiency and product quality (23).

We were surprised to see minimal experience with digital twins, which are virtual replicas or simulations of physical systems or processes based on real-time data from biomanufacturing sensors. By comparing real-time data with expected values and process models, a digital twin can help operators identify deviations, anomalies, and other potential issues. That allows for proactive intervention and control strategies to maintain process integrity, optimize process parameters, and ensure product quality (47). Integration of such technologies can facilitate the advancement of industry 4.0 principles in biomanufacturing, where data-driven insights and digital simulations improve the robustness and sustainability of production processes. The relative absence of talent in this area possibly relates to the evolving adoption of digital twins and required expertise — such as that with ML and predictive analytics — that require proficiency in ML algorithms and statistical modeling, within a digital-twin framework.

Looking Ahead

Part 2 concludes this report in BPI’s March 2024 issue by first shifting from a focus on supply to that on demand, then discussing emerging, current, and future trends. Finally, we summarize our research findings and elucidate their limitations.

Acknowledgments

This material is based upon work supported by Evolution Search Partners Ltd. and the University of Dundee postgraduate program for business administration. Any opinions, findings, conclusions, or recommendations expressed in this material are those of the authors and not of the University of Dundee, University College London, or Evolution Search Partners Ltd.

References

1 Arden NS, et al. Industry 4.0 for Pharmaceutical Manufacturing: Preparing for the Smart Factories of the Future. Int. J. Pharmaceut. 602, 2021: 120554; https://doi.org/10.1016/j.ijpharm.2021.120554.

2 Erickson J, et al. End-to-End Collaboration To Transform Biopharmaceutical Development and Manufacturing. Biotechnol. Bioeng. 118(9) 2021: 3302–3312; https://doi.org/10.1002%2Fbit.27688.

3 Li G, et al. Data Science Skills and Domain Knowledge Requirements in the Manufacturing Industry: A Gap Analysis. J. Manufac. Sys. 60, 2021: 692–706; https://doi.org/10.1016/j.jmsy.2021.07.007.

4 Veile JW, Schmidt M-C, Voigt K-I. Toward a New Era of Cooperation: How Industrial Digital Platforms Transform Business Models in Industry 4.0. J. Bus. Res. 143, 2022: 387–405; https://doi.org/10.1016/j.jbusres.2021.11.062.

5 Markarian J. Automating Biopharma Manufacturing. Pharm. Technol. 46(7) 2022: 30–33; https://www.pharmtech.com/view/automating-biopharma-manufacturing.

6 Psarommatis F, May G, Azamfirei V. Envisioning Maintenance 5.0: Insights from a Systematic Literature Review of Industry 4.0 and a Proposed Framework. J. Manufac. Sys. 68, 2023: 376–399; https://doi.org/10.1016/j.jmsy.2023.04.009.

7 Longo F, et al. An Ontology-Based, General-Purpose and Industry 4.0-Ready Architecture for Supporting the Smart Operator (Part I — Mixed Reality Case). J. Manufac. Sys. 64, 2022: 594–612; https://doi.org/10.1016/j.jmsy.2022.08.002.

8 Joshi H, Patel J. A Literature Review on Emerging Trends in Adopting Industry 4.0 Within Pharmaceutical Industry. Technology, Agility and Transformation: Emergent Business Practices. Shah T, Bhatia M, Shome S, Eds. Allied Publishers: Bengaluru, India, 2023: 115–129.

9 Niazi S, Lokesh S. Advancements and Trends in Biomanufacturing. Biopharmaceutical Manufacturing, Volume 2: Unit Processes. IOP Publishing: Bristol, UK, 2022; https://doi.org/10.1088/978-0-7503-3179-1.

10 Pokhriyal P, Chavda VP, Pathak M. Future Prospects and Challenges in the Implementation of AI and ML in Pharma Sector. Bioinformatics Tools for Pharmaceutical Drug Product Development. Wiley: Hoboken, NJ, 2023: 401–416.

11 Xu X, et al. Reforming Global Supply Chain Management Under Pandemics: The GREAT-3Rs Framework. Produc. Operat. Management 32(2) 2023: 524–546; https://doi.org/10.1111/poms.13885.

12 Neal AD, et al. The Potential of Industry 4.0 Cyber Physical System to Improve Quality Assurance: An Automotive Case Study for Wash Monitoring of Returnable Transit Items. CIRP J. Manufac. Sci. Technol. 32, 2021: 461–475; https://doi.org/10.1016/j.cirpj.2020.07.002.

13 Zhang C, et al. A Multi-Access Edge Computing Enabled Framework for the Construction of a Knowledge-Sharing Intelligent Machine Tool Swarm in Industry 4.0. J. Manufac. Sys. 66, 2023: 56–70; http://dx.doi.org/10.1016/j.jmsy.2022.11.015.

14 Pagan-Castaño E, et al. What’s Next in Talent Management? J. Bus. Res. 141, 2022: 528–535; https://doi.org/10.1016/j.jbusres.2021.11.052.

15 Sahal R, Breslin JG, Ali MI. Big Data and Stream Processing Platforms for Industry 4.0 Requirements Mapping for a Predictive Maintenance Use Case. J. Manufac. Sys. 54, 2020: 138-151; https://doi.org/10.1016/j.jmsy.2019.11.004.

16 Bale AS, et al. Blockchain and Its Applications in Industry 4.0. A Roadmap for Enabling Industry 4.0 By Artificial Intelligence. Scrivener Publishing: Beverly, MA, 2022: 295–313; https://doi.org/10.1002/9781119905141.

17 Pesqueira A. Blockchain and Pharmaceuticals: A Bibliometric and Systematic Literature Review of Scientific Publications Between 2000 and 2021. Technology, Business, Innovation, and Entrepreneurship in Industry 4.0. Springer Nature Switzerland: Cham, Switzerland, 2023: 25–48; https://doi.org/10.1007/978-3-031-17960-0.

18 Dreyfus P-A, et al. Data-Based Model Maintenance in the Era of Industry 4.0: A Methodology. J. Manufac. Sys. 63, 2022: 304–316; https://doi.org/10.1016/j.jmsy.2022.03.015.

19 Bai C, Li HA, Xiao Y. Industry 4.0 Technologies: Empirical Impacts and Decision Framework. Produc. Op. Management 21 July 2022; https://doi.org/10.1111/poms.13813.

20 Xu X, et al. Industry 4.0 and Industry 5.0: Inception, Conception, and Perception. J. Manufac. Sys. 61, 2021: 530–535; https://doi.org/10.1016/j.jmsy.2021.10.006.

21 Kumar V, Srinivasan V, Kumara S. Smart Vaccine Manufacturing Using Novel Biotechnology Platforms: A Study During COVID-19. J. Comput. Inform. Sci. Eng. 22(4) 2022: 040903; https://doi.org/10.1115/1.4053273.

22 Beckwith J, et al.. The Talent Enigma in Digital Biomanufacturing. BioProcess Int. 21(1–2) 2023: https://bioprocessintl.com/business/careers/the-talent-enigma-in-digital-biomanufacturing.

23 Yang C-T, et al. Big Data and Machine Learning Driven Bioprocessing: Recent Trends and Critical Analysis. Biores. Technol. 372, 2023: 128625; https://doi.org/10.1016/j.biortech.2023.128625.

24 de Paula Ferreira W, et al. A Framework for Identifying and Analysing Industry 4.0 Scenarios. J. Manufac. Sys. 65, 2022: 192–207; http://dx.doi.org/10.1016/j.jmsy.2022.09.002.

25 Zhang G, Yang Y, Yang G. Smart Supply Chain Management in Industry 4.0: The Review, Research Agenda, and Strategies in North America. Ann. Oper. Res. 322, 2023: 1075–1117; https://doi.org/10.1007/s10479-022-04689-1.

26 Whysall Z, Owtram M, Brittain S. The New Talent Management Challenges of Industry 4.0. J. Management Develop. 38(2) 2019; https://doi.org/10.1108/jmd-06-2018-0181.

27 Li M, et al. Graduation-Inspired Synchronization for Industry 4.0 Planning, Scheduling, and Execution. J. Manufac. Sys. 64, 2022: 94��–106; https://doi.org/10.1016/j.jmsy.2022.05.017.

28 Coons R. Developing Supportive Bioeconomy Policies. Indust. Biotechnol. 19(2) 2023: 35–36; https://doi.org/10.1089/ind.2023.29310.editorial.

29 Sadiku MNO, Ajayi-Majebi AJ, Adebo PO. Biomanufacturing. Emerging Technologies in Manufacturing. Springer International: New York, NY, 2023: 259–273.

30 Albert ET. AI in Talent Acquisition: A Review of AI-Applications Used in Recruitment and Selection. Strat. HR Rev. 18(5) 2019: 215–221; http://dx.doi.org/10.1108/SHR-04-2019-0024.

31 Liebrecht C, et al. Decision Support for the Implementation of Industry 4.0 Methods: Toolbox, Assessment, and Implementation Sequences for Industry 4.0. J. Manufac. Sys. 58(Part A) 2021: 412–430; http://dx.doi.org/10.1016/j.jmsy.2020.12.008.

32 Bisschops M, Cameron L. Process Intensification and Industry 4.0: Mutually Enabling Trends. Process Control, Intensification, and Digitalisation in Continuous Biomanufacturing. Wiley VCH: Weinheim, Germany, 2022: 209–229; http://dx.doi.org/10.1002/9783527827343.ch7.

33 Dieste M, Sauer PC, Orzes G. Organizational Tensions in Industry 4.0 Implementation: A Paradox Theory Approach. Int. J. Produc. Econ. 251, 2022: 108532; https://doi.org/10.1016/j.ijpe.2022.108532.

34 Gumbo S, et al. Skills Provisioning for the Fourth Industrial Revolution: A Bibliometric Analysis. Procedia Comput. Sci. 219, 2023: 924–932; https://doi.org/10.1016/j.procs.2023.01.368.

35 Neumann WP, et al. Industry 4.0 and the Human Factor: A Systems Framework and Analysis Methodology for Successful Development. Int. J. Produc. Econ. 233, 2021: 107992; https://doi.org/10.1016/j.ijpe.2020.107992.

36 Green GM, et al. Recommendations for Workforce Development in Regenerative Medicine Biomanufacturing. Stem Cells Translat. Med. 10(10) 2021: 1365–1371; https://doi.org/10.1002%2Fsctm.21-0037.

37 Berger T, Frey CB. Digitalisation, Jobs, and Convergence in Europe: Strategies for Closing the Skills Gap. Oxford Martin School: Oxford, UK, 2016: https://www.oxfordmartin.ox.ac.uk/downloads/reports/SCALE_Digitalisation_Final.pdf.

38 Moldovan L. State-of-the-Art Analysis on the Knowledge and Skills Gaps on the Topic of Industry 4.0 and the Requirements for Work-Based Learning. Procedia Manufact. 32, 2019: 294–301; https://doi.org/10.1016/j.promfg.2019.02.217.

39 Vista A. Data-Driven Identification of Skills for the Future: 21st-Century Skills for the 21st-Century Workforce. Sage Open 10(2) 2020: 2158244020915904; https://doi.org/10.1177/2158244020915904.

40 Arents J, Greitans M. Smart Industrial Robot Control Trends, Challenges, and Opportunities within Manufacturing. Appl. Sci. 12(2) 2022: 937; https://doi.org/10.3390/app12020937.

41 Dabić M. Unappreciated Channel of Manufacturing Productivity Under Industry 4.0: Leadership Values and Capabilities. J. Bus. Res. 162, 2023: 113900; https://doi.org/10.1016/j.jbusres.2023.113900.

42 McGunagle D, Zizka L. Employability Skills for 21st-Century STEM Students: The Employers’ Perspective. Higher Ed. Skills Work-Based Learn. 10(3) 2020: 591–606; http://dx.doi.org/10.1108/HESWBL-10-2019-0148.

43 Vogel-Heuser B, Hess D. Guest Editorial Industry 4.0: Prerequisites and Visions. IEEE Transac. Automat. Sci. Eng. 13(2) 2016: 411–413; https://doi.org/10.1109/TASE.2016.2523639.

44 Huang Z, et al. A Survey on AI-Driven Digital Twins in Industry 4.0: Smart Manufacturing and Advanced Robotics. Sensors 21(19) 2021: 6340; https://doi.org/10.3390/s21196340.

45 Pandey M, Singhal B. Blockchain Technology in Biomanufacturing: Current Perspective and Future Challenges. Blockchain Technology for Emerging Applications: A Comprehensive Approach. Academic Press: Cambridge, MA, 2022: 207–237; https://doi.org/10.1016/C2020-0-03280-9.

46 Sarmadi A, Hassanzadeganroudsari M, Soltani M. Artificial Intelligence and Machine Learning Applications in Vaccine Development. Bioinformatics Tools for Pharmaceutical Drug Product Development. Scrivener Publishing: Beverly, MA, 2023: 233–253; https://doi.org/10.1002/9781119865728.

47 Richter J, et al. Digital Twins in Bioprocess Engineering: Challenges and Possibilities. Chem. Ing. Technik. 95(4) 2023: 498–510; https://doi.org/10.1002/cite.202200166.

Corresponding author Jason Beckwith, PhD, is managing director of Evolution Search Partners Ltd. in Glasgow, UK, and a researcher in the department of business at the University of Dundee; 44-7899 950002; [email protected]. Paul Rooney, BSc, is a research consultant, and Gregor Adams is a research assistant, both with Evolution Search Partners Ltd. William Nixon, PhD, is a emeritus professor, and Stavros Kourtzidis, PhD, is deputy associate dean of research, both in the department of business at the University of Dundee. Stephen Goldrick, PhD, is an associate professor in the department of bioprocess engineering at University College London. The authors report no declarations of interest.