Automation, innovation, and process optimization are driving higher yields, lower costs, and multiple capacity options for biomanufacturers, says BioPlan Associate’s Eric Langer.

Ahead of the trade show on November 1-3, BioPlan Associates produced an article for the CPHI Frankfurt Annual Report, presenting a detailed analysis of the findings from its Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production and predicting key trends for the future of biomanufacturing.

The key takeaways are:

gustavofrazao

Industry growth: Over the past 10 years has consistently pegged at ~12% – 13% annually, nearly doubling every ≥5 years. This year’s growth during COVID-times has, for some segments more than doubled that growth.

Efficiency and productivity improvements: Titers and yields continue to incrementally increase. 2021 showed the lowest average cost-per-gram on record.

Process automation: A critical element being built into bioprocessing equipment.

International biomanufacturing and offshoring continue to grow worldwide, especially in major markets and Asia. This now includes an upcoming wave of facilities coming online for Covid-19 and other pandemic and biodefense product development and manufacturing.

Growth of contract manufacturing facilities and capacity provide greater outsourced options.

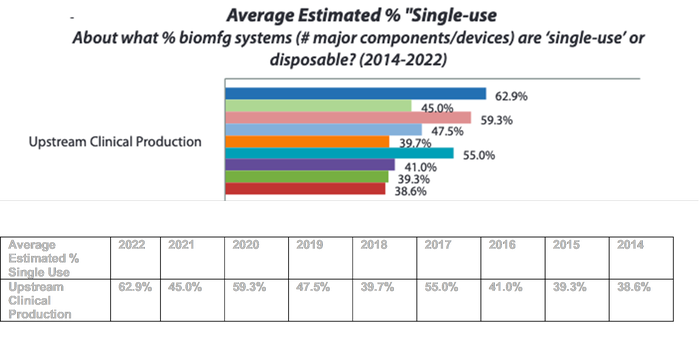

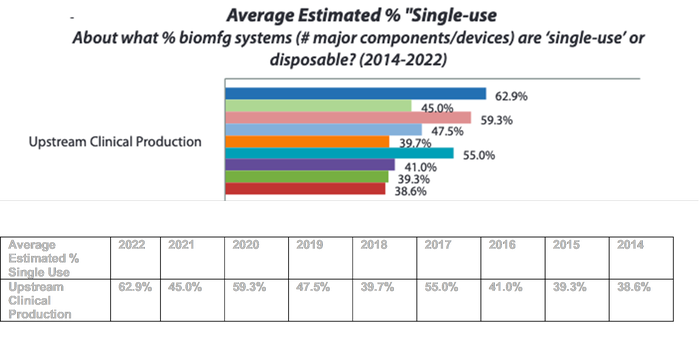

Increased reliance on single-use vs. stainless steel-based processing including fewer new commercial scale stainless steel-based facilities.

Hiring challenges in biopharmaceutical manufacturing continue to create significant bottlenecks. Finding qualified staff at global facilities continues to be a problem for over 50% of the industry.

Ahead of its publication, we spoke with Eric Langer, managing partner at BioPlan Associates, to discuss these trends further:

BioProcess Insider (BPI): what are the capacity implications affecting innovators over the next few years?

Eric Langer (EL): There are likely sufficient bioprocess alternatives available at smaller (early) scale, including multiple CDMOs that are offering shorter wait times, strategies for using single-use technologies, especially at smaller scale, etc. Although SUS [single-use system] devices have been in short supply during COVOD, this supply chain challenge is lightening up slowly. So over the next three years, we will be seeing a normalization of the supply chain, and additional build out of capacity.

The real challenge will continue to be having access to human capital, trained and skilled staff with the quality expertise required to manufacture at GMP. Further, as demand for skills grow (with the growth of cell and gene therapy pipelines, and growth of Asia biopharma), the challenges of hiring and retaining good staff will become more acute.

Large-scale (late phase and commercial), will have similar challenges in terms of hiring, but there will still be options available for physical capacity for bioproduction, especially as covid challenges abate.

BPI: Will development timelines be slowed if innovators struggle to access CDMOs and have limited inhouse resources? Could this slow approvals or will it just drive wages up and bring more people into the industry?

EL: The value and importance of novel therapies to healthcare and to investors cannot be overestimated. So when an innovative therapeutic is advancing in the pipeline, we will see increasing examples of flex capacity, as well as CDMO and inhouse capacity coming online. It is unlikely that the pipeline will be stoppered as a result. Rather, efficiencies will be innovated, automation will be invested, and processes will be created to meet the capacity need. Some of the options may be more expensive than ideal, but even these will likely settle down over time.

BPI: According to your report, “2021 showed the lowest average cost-per-gram on record.” Are we in an age of steady titer improvements continuing year after year and could we see year-on-year improvements in the way we have seen for, say, processing power in computer chips?

EL: The cost-per-gram is not just titer, but overall bioprocessing. Efficiency and productivity is the number one focus—this has driven costs down. But yes, titer is a significant contributor, since doubling titer cuts bioreactor sizes dramatically. However, downstream costs still remain high, and will remain so until alternative chromatography/separation steps are adopted.

BPI: Looking ahead, what do you read into the implications of single-use tech and automation? what improvements do you expect to see in the next few years?

EL: Automation and SUS cut demand for trained staff, reduce costs, and enable both small- and large-scale bioprocessing. So yes, we’ll see more, especially since so many suppliers are working to improve and integrate automation at so many steps. In the next three years, we’ll see gradual adoption. But in this regulated industry, everything happens slower than many would prefer.

BPI: Can bio growth continue to buck macro trends and continue these high double-digit rates for the next 5-years (i.e. the report said growth roughly doubles every 5-years)? What is your outlook for bio in 2027, say?

EL: COVID has created a bubble for suppliers in terms of revenue, and to some extent of volume, as buying and stockpiling continue. This will abate as supply factors related to COVID diminish. Bio will continue to follow the underlying (healthy) 12-14% growth rate it has seen in terms of revenue from therapies, as well as derived revenue for supplies for bioproduction.

The doubling of profits among suppliers will likely not continue as supply chains normalize, competition increases along with a return to discounting. Further, new suppliers in the industry, many of whom have seen rapid growth as a result of demand due to COVID shortages, will continue to provide alternatives to the major suppliers. Some of these suppliers are coming from Asia/China, where the domestic industry is growing even faster than in the US/EU, and where demand for consumables has created domestic competitive alternatives, where only multi-national suppliers had existed just five years ago.

Eric Langer will be presenting at Bioproduction, part of CPhI Frankfurt, on November 2 at 16h30

schedl_b_and_w.jpg?width=100&auto=webp&quality=80&disable=upscale)

schedl_b_and_w.jpg?width=400&auto=webp&quality=80&disable=upscale)