AbbVie expects impact from Humira (adalimumab) biosimilars in Europe beginning the fourth quarter but remains confident there will be no direct US competition until 2022.

AbbVie is preparing for Humira biosimilar entrants beginning in the fourth quarter 2018, the firm said during a first quarter conference call.

A settled lawsuit with Samsung Bioepis earlier in the quarter laid the way for the Korean firm’s adalimumab biosimilar Imraldi to be launched as soon as October 16 by commercialization partner Biogen.

Meanwhile, Fujilfilm began preparing its commercialization plans for its biosimilar, FKB327, teaming up with Indian drugmaker Mylan. If approved, FKB327 will be just one of a number of adalimumab biosimilars looking to chip away at Humira’s estimated US$4.1 billion (€3.4 billion) European revenues, battling against Amgen’s Amgevita (and duplicate product Solymbic) and Boehringer-Ingelheim’s Cyltezo.

“We have started our preparation activities for biosimilars outside the US in those countries that are going to face biosimilar activity in the fourth quarter of this year,” AbbVie CEO Richard Gonzalez told stakeholders on a conference call (see transcript here).

20% Erosion

Sales outside the US for Humira, AbbVie and the world’s best-selling drug, grew 9.3% year-on-year for Q1, clocking in $1.7 billion, and Gonzalez said he expected EU sales to continue to increase all the way up to the entrance of biosimilars, “and then you will start to see the impact.”

The erosion rate from Q4 onwards could be as much as 20%, he added, based on previous experience of biosimilars in the EU.

“Without seeing actually what their launch strategy looks like, we’re modeling everything against what we’ve seen with Remicade and what we’re seeing right now with Enbrel.”

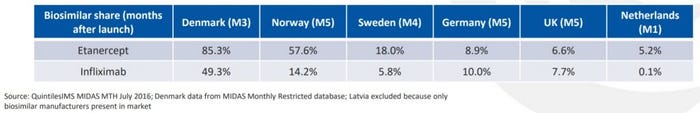

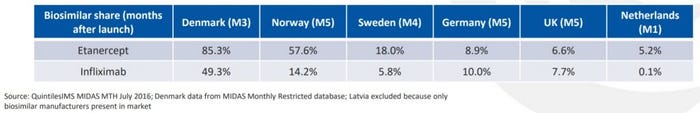

Following the launch of versions of J&J’s Remicade (infliximab) in Europe, the biosimilar share was single-digit percentages in the UK and Germany, but as high as 85% in Denmark.

QuintileIMS report July 2016 (click to view full version)

“And what we’re modeling here is pretty consistent with what we’re seeing out there. I don’t fundamentally believe we should see something a lot different, but we want to see what that experience looks like. If it’s different than what we’ve described, we’ll obviously update the market once we have more experience with it.”

US Launch

But while in the US adalimumab biosimilars are also lining up, AbbVie is confident it will not see direct competition until 2022 at the earliest.

“Since our first settlement with Amgen back in 2017, the strength of our IP portfolio has been further validated by four successful IPR decisions. We remain confident that we will not see direct biosimilar competition in the US until at least 2022.”

Following a series of legal disputes, Amgen came to a settlement with AbbVie in September 2017 – a year after its biosimilar Amjevita received US approval – not to launch until January 2023.

“In reaching this agreement, we have achieved the balance between protecting investment in innovation and providing access to biosimilars, which will play an important role in our health care system,” Laura Schumacher, EVP of external affairs, general counsel and corporate secretary at AbbVie said at the time.

schedl_b_and_w.jpg?width=100&auto=webp&quality=80&disable=upscale)

schedl_b_and_w.jpg?width=400&auto=webp&quality=80&disable=upscale)