Content Spotlight

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

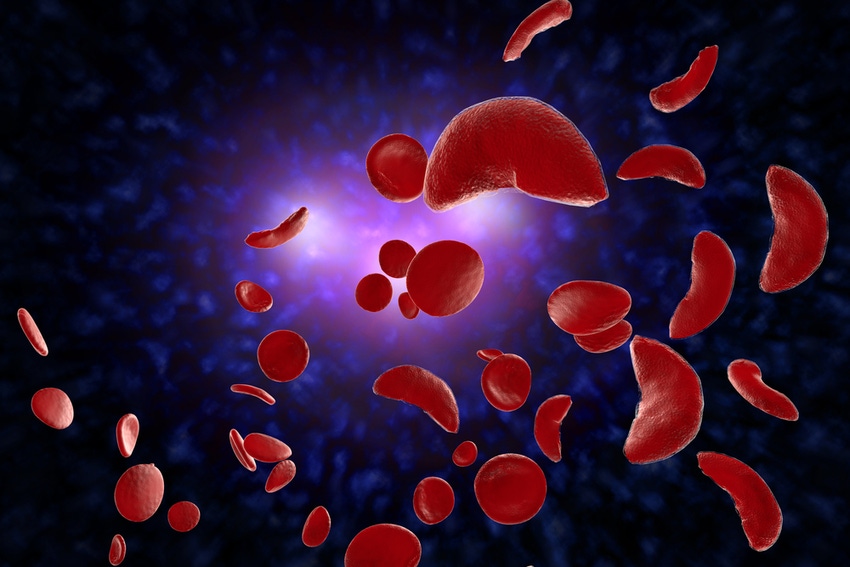

In December 2023, the US Food and Drug Administration (FDA) approved Lyfgenia (lovotibeglogene autotemcel; lov-cel) as a one-time gene therapy treatment for sickle cell disease.

Three months on, and the firm told investors it is ready for full launch, leveraging the commercial head start established by bluebird’s 2022 approval of beta-thalassemia gene therapy Zynteglo (betibeglogene autotemcel; beti-cel).

“We are seeing the fruits of that labor translate into real momentum for Lyfgenia. We have activated 62 qualified treatment centers and have signed our first outcome space agreement for Medicaid, extending access to Lyfgenia to this critical patient population,” CCO and COO Tom Klima said on his firm’s Q4 2023 earnings call last month.

“Three months into the Lyfgenia launch, patient demand is strong [...] we expect our first patient start will be scheduled imminently, and we are extremely encouraged by the number of enrollments and patients preparing for treatment from multiple treatment centers across our QTC [Qualified Treatment Center] network. We anticipate starts for Lyfgenia to grow quarter-over-quarter, with the majority occurring in the second half of the year as momentum builds.”

He added the first revenues for Lyfgenia will be reported in Q3.

Like Zynteglo and bluebird’s other approved gene therapy Skysona (elivaldogene autotemcel; eli-cel), Lyfgenia is lentiviral vector -based. The lentivirus is used to introduce genetic modifications into the patient’s blood stem cells to produce a type of hemoglobin A, which fills in for dysfunctional ones.

However, the production of Lyfgenia is based on a different supply chain to Zynteglo and Skysona, according to CEO Andrew Obenshain.

“The supply chain for Zynteglo or Skysona is one supply chain, and then there's the supply chain for Lyfgenia – the two don't impede upon each other,” he told stakeholders. “We've designed our capacity for Lyfgenia to be larger than our capacity for Zynteglo and Skysona in anticipation of a larger demand there,” he continued, both from the drug substance and drug product side.

“We do anticipate that we have the volume or the capacity to meet the initial launch expectations, and what we also have in place is plans to expand that capacity as we see demand coming in.”

You May Also Like