Content Spotlight

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

Sangamo Therapeutics will close its Brisbane manufacturing plant, axing 162 jobs, in plans to cut annual operating costs by around 50%.

While a streamlining strategy to focus on neurological diseases and AAV capsid delivery technologies has been in place at Sangamo since 2020, the macroeconomic environment has led to the genomics firm announcing a series of measures to expedite a restructure.

“Over the course of 2023, we have proactively made difficult decisions to preserve our most valuable assets. The public biotech markets have been challenging for over two years now and we find ourselves in a similar position to many of our peers with limited capital resources and a tough path to navigate ahead,” CFO Prathyusha Duraibabu told stakeholders on third quarter financials call last week.

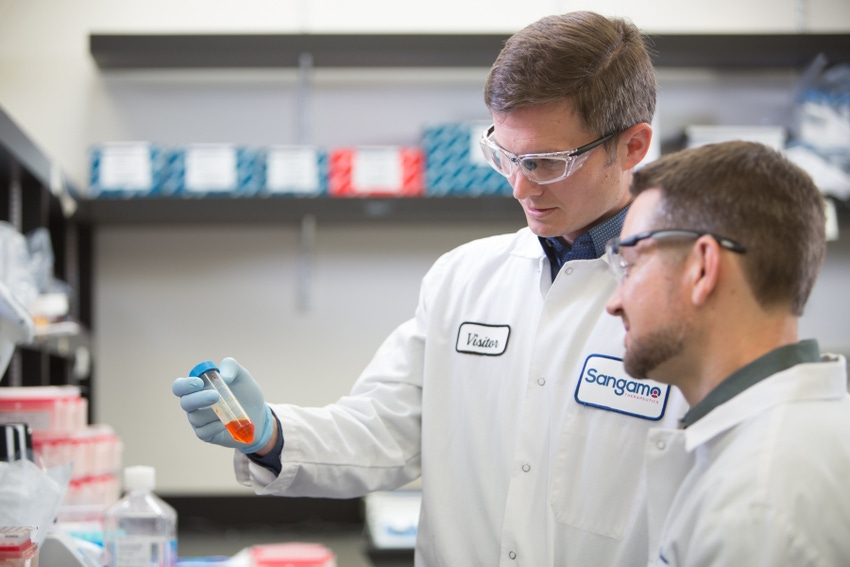

Image c/o Sangamo Media Library

“This has necessitated the exploration of our strategy execution, and the focus of spending in line with our mission as a neurology-focused genomic medicine company.”

Among the measures announced is the exit from Sangamo’s Brisbane, California facility in early 2024. The firm announced plans to move into the 88,000 square foot building at Oyster Point in Brisbane in 2017 and brought online Phase I/II manufacturing capabilities at the site three years later.

“We will be scaling back our internal manufacturing capabilities and leveraging external partners to manufacture clinical supply for our neurology pipeline,” said Duraibabu, adding 162 roles – or 40% of Sangamo’s US workforce – are to go.

“The annual cost savings resulting from the workforce reduction, combined with other potential cost reductions is expected to reduce our annual operating and all non-GAAP operating expenses from $240 million to $260 million this year to around $150 million to $135 million in 2024, a decrease of approximately 50% year-over-year.”

Other measures being taken by Sangamo include the deferment of further investments and the seeking of collaboration partners or direct investment for both its Fabry gene therapy and CAR-Treg cell therapy programs.

Sangamo, meanwhile, will transition its headquarters to the Richmond, California facility as of January 1, 2024.

According to CEO Sandy Macrae, “Point Richmond is the original home of Sangamo [and] is where Zinc Finger editing and capsid development capabilities are based. These actions are designed to focus our cash resources in advancing our Zinc Finger platform and our capsid discovery engine.”

Zinc Finger Nuclease (ZFN) technology is composed of a DNA-binding domain, which binds with precision to any sequence of DNA, and various functional domains (such as nucleases and transcription factors) based on therapeutic need. Sangamo has partnered with several firms to develop advanced therapies using this technology, including with Alexion (part of AstraZeneca), and Takeda.

You May Also Like