Advances in Bioprocessing: Single-Use and Stainless Steel Technologies

December 18, 2015

Upstream processing at an IDT Biologika facility in Germany (left) and a SynCo Bio Partners facility in the Netherlands (right) (WWW.IDT-BIOLOGIKA.COM) (WWW.SYNCOBIOPARTNERS.COM)

The increasing penetration of disposable devices in the biopharmaceutical manufacturing industry has been well documented, and with good reason. These applications represent a new paradigm in the evolution of biomanufacturing technologies and practices, opening the industry up to new possibilities such as flexible and modular facilities.

But stainless steel applications and innovations remain vital to this industry. Some stainless devices may be irreplaceable, including large tanks, autoclavable and heat-sterilized fermentors and bioreactors, and storage and filling devices. Other innovations in fluid handling and storage are vital to bioprocessing.

But as the industry transitions from fully stainless steel bioprocessing, to hybrid (or even fully disposable) systems, manufacturing strategies and decisions are changing. Managers are deciding on manufacturing strategies that may “stick” a facility with outdated technologies for the life of a process or a biologic — perhaps 10 or more years. Today, companies are forced to make decisions using incomplete data on a technology’s performance, economics, or long-term effectiveness. Moreover, as new technologies are introduced (e.g., perfusion and other continuous bioprocesses), even more novel devices are offered. Picking the right technology for the long haul is getting harder.

Single-Use Innovation in Demand

The growth in adoption of single-use systems (SUS) and devices has been impressive, with certain applications now almost fully permeating earlier-stage manufacturing. From our latest industry study — 12th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production (1) — among disposables users, nearly nine in 10 are now using a variety of SUS applications. Such components include connectors and clamps, preassembled tubing sets and rigging kits, tubing for disposable applications, and sampling systems (for scale-up and clinical productions). Although adoption rates are lower for commercial production, most disposables users are relying on those applications and others (e.g., depth filters, buffer containers, and tangential-flow filtration devices) for commercial manufacturing.

This trend continues to be led by contract manufacturing organizations (CMOs), which stand to benefit from more rapid changeover times and the reduction of cross-contamination risks. CMOs lead in adoption for nearly all

SUS areas, with clinical-scale bioreactor use a notable exception (75% among biotherapeutic developers compared with 67% among CMOs).

Add it all up, and respondents to our study this year estimated that almost 40% of their clinical production operations are single use, led by upstream (39% share) and followed closely by downstream (38%). Not surprising, estimates are lower for commercial production, but respondents still estimated that almost one-fifth of their upstream (18%) and downstream (17%) production operations are in single-use systems.

More Single-Use Innovations Expected

Another measure of the appeal of single-use equipment is the consistent demand for innovation in this area. Year after year, these devices are near or at the top of the list of new product development areas on which biomanufacturers want their suppliers to focus their attention. The following disposable devices are typically in the top third:

disposable purification products (first on the list of new product development areas of interest this year, with 36% of industry respondents choosing it as a top-five area)

disposable probes and sensors (third on the list, cited by 35%)

disposable bioreactors (fifth on the list, cited by 32%)

disposable bags and connectors (seventh on the list, cited by 29%).

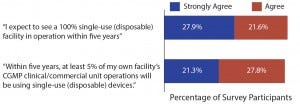

Figure 1: Single-use and disposable device adoption issues (1)

Given the pace of — and demand for — innovation in single-use equipment, it’s not surprising to see that the industry expects fundamental changes in manufacturing processes for the near future. According to our survey, nearly half (49.5%) of the industry expects to see a 100% single-use (disposable) facility in operation within the next five years, with these new facilities presumably being new operations using upstream bioreactors and downstream disposable chromatography operations (Figure 1).

Likewise, almost half (49.1%) of qualified respondents this year agree

that within five years at least 50% of their own facility’s current good manufacturing practice (CGMP) clinical/commercial unit operations will be substantially done using single-use (disposable) devices (Figure 1).

The impact of these developments is large. Although there’s still some debate to be had about the cost-savings afforded by the adoption of single-use devices, they do allow for reduced capital investments in facilities and equipment, faster campaign turnaround times, more flexibility, and reduced time to get facilities up and running. The end result of those benefits is greater efficiency and speed in manufacturing processes, which continue to be leading goals for biomanufacturers. As single-use applications mature, we would expect them to become more standardized, leading to still lower costs and greater efficiency.

What About Stainless Steel Equipment?

There’s no denying that at least in commercial manufacturing, stainless steel continues to be the main paradigm. With essentially 80% of commercial-scale bioprocessing operations using primarily stainless steel equipment, this technology is a permanent fixture. That is in part due to existing investments in such systems, because changing an existing facility from stainless steel to disposable technology is not a simple task. Yet, stainless steel equipment is also proven, familiar, and well-trusted, even if it can be more expensive and labor intensive.

Moreover, the standardization that single-use equipment lacks has been largely adopted by stainless steel manufacturers. This is at least partially due to their several decades of use, unlike the relative newness of single-use equipment. Despite some complaints about the quality of steel now being used, stainless steel bioprocessing equipment is likely to have more consistent content and quality than single-use systems, which have more complex and diverse chemical make-up (in the plastics) and which require more vigilance and rigorous control of related supply chains.

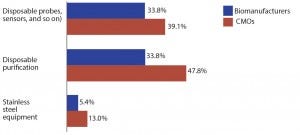

Figure 2: Selected new product development areas of interest; top areas for which suppliers must focus development efforts on biotherapeutic developers and CMOs)

With terms such as legacy and dinosaur being bandied around for stainless steel equipment, it’s to be expected that the industry’s current innovation focus is squarely on single-use systems rather than stainless steel. Indeed, of the 21 new product development areas we tested, stainless steel equipment ranked last in innovation demand, cited by just 5.3% of biomanufacturers (Figure 2). However, although innovation currently is not being expected of stainless equipment, that may change.

Stainless Steel Is Here to Stay

Stainless steel equipment still thoroughly dominates commercial manufacturing, and the need for improvements remains. Ironically, the manufacturers of those systems may be looking to the advantages of single-use systems for inspiration.

Indeed, innovation in stainless steel equipment may trend toward making this equipment more modular, a benefit typically ascribed to single-use equipment. For example, newly developed hardware components of stainless steel bioreactors can take on modular designs, allowing for easy installation in existing bioreactors. Software components also can be designed for modularity, giving added flexibility. And even stainless steel totes can have a modular design concept to accommodate high-volume biocontainers.

Other innovations in stainless steel equipment might come in the areas of sensors, process control, and perfusion processes. And there’s likely to be a growing focus on hybrid systems, in which stainless-steel facilities can adapt single-use equipment into their facilities more easily. Single-use systems may never be as cost-effective at the largest manufacturing scales (such as for blockbuster antibody manufacture). Based on economics, most companies today, including those using exclusively single-use devices for development, convert in later stages of development to stainless steel systems for CGMP commercial manufacturing. Currently, ∼85% of those surveyed report manufacturing in stainless steel, and >75% expressed a preference for stainless steel equipment for new commercial manufacturing facilities.

Two Evolving Technologies

Stainless steel is a fully mature technology platform and remains more cost-effective than single-use for commercial product manufacture (where productivity is most important, and flexibility and related changes are less significant). Despite rapid adoption of single-use systems at smaller scales, use of stainless steel is growing and will continue to grow, just not as rapidly. Even 10 years from now, and perhaps longer, reusable equipment will remain the dominant commercial bioprocessing platform, with single-use adoption for commercial manufacture continuing to ramp up.

Although single-use devices are gaining strong levels of enthusiasm and making a significant impact on bioprocessing, room remains for innovation in stainless steel equipment. Stainless steel innovation continues to suffer from low demand, but this may be the result of single-use equipment simply being newer and fresher. Given that stainless steel equipment continues to dominate commercial manufacturing, improved modularity, sensors, perfusion devices, and process control mechanisms would no doubt be welcomed by end users.

References

1 12th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production. BioPlan Associates: Rockville, MD, April 2015; www.bioplanassociates.com/12th.

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., 2275 Research Blvd, Suite 500, Rockville, MD 20850; 1-301-921-5979; elanger@ bioplanassociates.com.

You May Also Like