Biopharmaceutical Mergers and Acquisitions: Their Impact on the Services Industry

The biopharmaceutical industry is, and always has been, rife with mergers and acquisitions (M&A) activity, with small biotechnology companies combining technology and platforms, mid-size organizations diversifying pipelines, and larger corporations replenishing products under the weight of expiring intellectual property (IP). And then come the multibillion-dollar megamergers: Glaxo Wellcome and SmithKline Beecham, Pfizer and Wyeth, and Merck and Schering-Plough, for example.

Few people expected 2022 to be an exception. According to a recent Ernst & Young (EY) report, the industry’s value stood at a record US$1.4 trillion, up 11% over 2021 (1). Meanwhile, a wave of patent expirations loomed, and biotechnology stock valuations were at their lowest in years. Despite those factors, the year saw the lowest amount of M&A activity in a decade. EY listed 71 deals over $100 million in value, all totaling $60 billion in 2022, which was down from $104 billion in such deals the previous year. Both were less than half of the record $261 billion total for 2019, which was driven primarily by a $74 billion megamerger of Bristol Myers Squibb (BMS) and Celgene (2) and Takeda’s $62 billion acquisition of Shire (3).

In a recent discussion with BioProcess Insider, Paul Manlapig (director at Wombat Capital) said that “the muted biopharma M&A market in 2022 is a microcosm of the general economic sentiment. The year closed with major stock markets down, plagued by fears of rising inflation, higher interest rates, the Ukraine war, and a potential recession.” In the United States, Standard and Poor’s S&P 500 index ended down by ~20%, and London’s Financial Times Stock Exchange (FTSE) 100 was up by only ~1%.

“In the biopharma sector,” he continued, “that led to company valuations being depressed, with less appetite from buyers and investors in both the public and private markets to make acquisitions and provide funding. Strategic buyers were sitting on the sidelines as most biopharma targets were plagued with funding woes and struggling to progress their large molecules through clinical trials. Private equity buyers struggled to hit their target return on investments (RoIs) with higher interest rates to finance their acquisitions.”

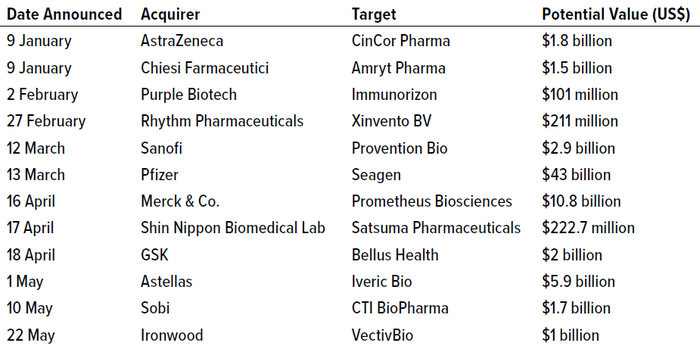

The first half of 2023, however, has shown signs of recovery (Table 1). Those technically began in late 2022 with Amgen’s attempt to add 12 marketed medicines, a pipeline of over 20 development programs, and more than 2,000 employees through a $27.8 billion bid for Horizon Therapeutics (4). And a plethora of deals have followed. The first quarter of 2023 brought four deals over a billion dollars in value, culminating in the proposed $43 billion acquisition of antibody–drug conjugate (ADC) pioneer Seagen by big-pharma company Pfizer (5). In the second quarter up to the end of May, another five $1+ billion deals were announced. The numerous high-value alliances, partnerships, and investments also in 2023 are outside the scope of this discussion.

Table 1: Drug-developer mergers and acquisitions (M&A) deals announced in 2023 worth over US$100 million (HTTPS://INVIVO.PHARMAINTELLIGENCE.INFORMA.COM).

The financial resurgence is not yet fully realized. “M&A deals very much depend on the state of the capital markets,” said Manlapig. “Funding is the lifeblood of biopharma M&A, and so far the debt and equity markets are providing mixed signals, which still breeds uncertainty for biopharma M&A to have a strong resurgence in the near term.”

Moreover, he pointed to the secured overnight financing rate (SOFR) and the three-month London interbank offered rate (LIBOR), a methodology designed to produce an average exchange rate between the United States and the United Kingdom. In June, those rates hovered at ~5.0% and ~5.5%, respectively, compared with ~4.3% and ~4.8% at the end of 2022. Such values limit companies’ ability to fund acquisitions purely on debt. “Creative deal structuring could be another avenue,” said Manlapig. “With the S&P 500 mid-June year-to-date performance up by over 12.0%, perhaps sellers will be more open to accepting equity as part of deal considerations.”

As for the big-pharma organizations, he pointed to their historic power in working with regulators to push large deals through. But both Amgen and Pfizer’s respective acquisitions (of Horizon and Seagen) remain under government review, making some experts question whether the drug industry giants still can flex their muscles at will.

Manlapig called the Federal Trade Commission’s (FTC’s) move to block Amgen’s Horizon acquisition “unprecedented in that it is the first time the agency has used past bundling-scheme and drug-pricing behavior as an argument in its lawsuit” (6). Even if industry experts believe that argument is unlikely to prevail in court, he explained, those same experts expect the FTC to continue scrutinizing such megamergers as a way to express its frustration with the US Congress’s inability to strengthen antitrust laws. Such FTC efforts can be thought of “in conjunction with the agency’s ongoing investigations of large pharmacy benefit managers’ (PBMs’) drug-pricing business practices.” And as of this writing (22 June 2023), the Amgen deal faces more problems with the states of California, New York, Illinois, Minnesota, Washington, and Wisconsin joining that FTC lawsuit (7), claiming that such a merger would enable Amgen to “dominate” prescription drug markets.

As for the Pfizer–Seagen transaction, Manlapig said that to succeed, both parties should be as collaborative and responsive as possible with the FTC and/or Department of Justice (DoJ) throughout their merger-review process (8). Under the US Hart–Scott–Rodino (HSR) Act, parties to certain large M&A must file premerger notification and wait for government review before closing their deals.

Return to Vendors

Despite sometimes bumpy pathways to get there, biopharmaceutical M&A (particularly megamergers) tend to streamline operations and processes ultimately as acquirers recognize synergies and save costs throughout the often-bloated new entities that result. Often the first elements to be carved away are those that contribute to the risk of overcapacity of in-house footprints. For example, Pfizer restructured its manufacturing network after acquiring Wyeth, immediately earmarking eight plants for closure following the completion of that deal in 2010 (9). Over the ensuing 12 years, Pfizer whittled its global network down from 78 plants to 36 (10), though that of course goes beyond M&A synergies and also represents increasing big-pharma reliance on outsourcing.

Contract development and manufacturing organizations (CDMOs), contract research organizations (CROs), and bioprocess suppliers watch M&A movements among their potential customers closely. Such upheavals in the industry landscape can have both positive and negative repercussions for the larger biopharmaceutical ecosystem.

Thermo Fisher Scientific, which serves both as a CDMO and as a supplier of equipment and materials, has lauded the opportunities for service companies that M&A can create. In megamerger-heavy 2019, CEO Marc Casper said his company has historically “done well when the pharmaceutical industry has consolidated because we are part of the synergy plans, and we bring our best thinking and help our customers meet their innovation and productivity level” (11).

Manlapig warned, however, that pharma M&A may not be quite as rosy for some suppliers. As their client companies become larger, that enables them “to flex their muscles to gain favorable supplier terms.” It also could lead to further customer concentration for CDMOs, CROs, and equipment vendors, but in general he highlights the positives.

Divestitures of manufacturing facilities that often follow M&A as the combined entities rationalize their asset portfolios may represent one positive opportunity. CDMOs NextPharma and Rentschler both have picked up facilities from the fallout from Shire’s takeover of Baxter and then Takeda’s buyout of Shire, respectively (12, 13). And after the BMS–Celgene deal, Catalent snapped up a fill–finish plant in Italy, whereas Korean CDMO Lotte picked up a drug-substance plant in East Syracuse, NY (14, 15).

M&A activity also tends to bring a talent exodus from the combined organizations — which according to Manlapig can be another boon for third parties. “A good number of [people] decide to establish either their own CDMOs/CROs or biopharma startups, which breeds further competition in the industry, or they become potential customers for CDMOs/CROs.” Increased competition could encourage fair pricing, technology innovation, and so on.

Manlapig suggested that supply-chain service companies should continue to diversify their revenue base by serving smaller customers and startups alongside consolidation in the biopharmaceutical sector. “Although revenue stability is a risk in serving these smaller customers, that should be counterbalanced by further customer diversification. Supply-chain services also should consider serving these smaller customers to be investing in long-term relationships. By becoming a trusted provider to such customers early on, there is the potential to capture a larger piece of the revenue pie when some of their products become commercial.”

CDMO Consolidation

Biopharmaceutical companies are not the only ones using M&A for growth. Originally known as CMOs or, more simply, third-party manufacturers, CDMOs always have been the subject of chatter about the industry being fragmented and ripe for consolidation (16, 17). However, current market conditions make investors cautious about M&A, said Manlapig, particularly about companies working in certain subsectors. “Some investors believe that there has been an overinvestment of capacity in the viral-vector space, particularly as there has been a slow pace of drug approvals using that technology. There is renewed interest in going back to more established technologies such as antibodies, recombinant proteins, and ADCs.”

In 2022, Vibalogics, Arranta Bio, and GenIbet brought small-molecule CDMO Recipharm’s gene-therapy, live-biologics, and recombinant-protein operations, respectively (18, 19). Asahi Kasei Medical, meanwhile, bought Bionova Scientific, citing its capabilities in next-generation antibody drug production, and Bora Pharmaceuticals spent $100 million to acquire the CDMO assets of Eden Biologics, adding such capabilities to its own small-molecule offerings (20). And although such M&A activity has been fairly restrained in 2023 so far, Lonza has bulked out its ADC capabilities through the $100+ million acquisition of Synaffix.

Contractors acquire for traditional reasons, such as a desire to add capacity, but some have been doing so to expand scientific capabilities in line with the emergence of new types of medicines. The most pronounced examples were in 2019, when $1+ billion deals were undertaken by Thermo Fisher and Catalent to add gene-therapy capabilities in the forms of Brammer Bio and Paragon Bioservices, respectively (21, 22). More recently, CDMOs are seeking mRNA and lipid-nanoparticle (LNP) capabilities, driven by the success of the Pfizer–BioNTech and Moderna vaccines against COVID-19.

“Drug developers are starting to explore mRNA technology as an alternative to gene delivery [that would] further mitigate the risk of mutagenesis,” said Manlapig. “There is currently a lot of interest in CDMOs with LNP drug-delivery capabilities.” Such particles could serve as efficient and targeted carriers of many therapeutic agents, from mRNA to genes, proteins, peptides, and so on. “Given that these technologies are relatively nascent, the CDMOs that specialize in them are either established players who have developed these technologies in house or early independent players that still need to scale capacity. Hence, a good number of transactions we’re likely to see at the onset will be growth-equity investors taking positions to fund capacity expansion in these small independent CDMOs.”

For example, Ampersand Capital Partners acquired a majority position in Phosphorex, a CDMO specializing in microsphere and LNP drug-delivery technologies, in August 2022 (23). And in April 2021, Signet Healthcare Partners invested in Ascendia Pharmaceuticals, a formulation development and dosage-form manufacturing CDMO that recently introduced its own LNP capabilities (24).

Manlapig added that some investors and buyers are looking further up the value chain to consider CDMOs “that serve as feeders to these different cell and gene therapy technologies and hence are technology agnostic. In particular, there is a good amount of interest to look at CDMOs that specialize in plasmid DNA manufacturing. The acquisition Sartorius announced in March 2023 of Polyplus, a leading provider of reagents and plasmid DNA, is a good example (25). Overall, M&A interest in the sector is still high, but it has been reallocated to technology niches.”

Vendor Blender

The Sartorius–Polyplus example brings up vendor-focused M&A. We have witnessed frantic dealmaking activity among bioprocess equipment and technology companies over the years. But unlike the CDMO sector, which remains fragmented to some degree, this segment now is effectively controlled by just a few companies: Danaher Corporation (including Cytiva and Pall), Thermo Fisher Scientific, Sartorius, MilliporeSigma, and (to a lesser extent) Repligen. Over the past couple years, M&A activity has centered effectively on their bolt-on acquisitions, with two or three deals made per company each year. Moreover, competition rules and industry dynamics are likely to preclude further megamergers like Merck KGaA’s $17 billion acquisition of Sigma-Aldrich or the more recent $21 billion Danaher–Cytiva (then GE Life Sciences) deal (26, 27).

However, those big vendors increasingly are thinking about diversifying their biopharmaceutical offerings beyond equipment and consumables. The resulting movements particularly into the CDMO space are creating megalithic life-science companies that offer full end-to-end development and manufacturing services that include equipment and materials. This seems to have begun with Thermo Fisher’s $7.2 billion acquisition of Patheon in 2017 (28), followed by the Brammer Bio buy two years later. Thermo’s $17.4 billion takeover of PPD in 2021 further exemplifies the concept of a true “one-stop shop” type of life-sciences giant. Combining CRO and CDMO services with all the equipment and consumables needed could be tempting for a small biotechnology or virtual pharmaceutical company that’s not interested in shopping around (29).

Beyond Thermo, MilliporeSigma continues to expand its own CDMO business, throwing $780 million into buying the LNP-focused Exelead in 2022 (30). Meanwhile Cytiva and Pall owner Danaher threw its hat into the CDMO ring in 2021 with the $9.6 billion acquisition of Aldevron. If the rumors were true, it also had been considering a Catalent takeover in a $20+ billion deal that would have shaken both the vendor and CDMO sides of the industry (31, 32).

It’s interesting to imagine just how large such companies could get. But Manlapig said that their moves into manufacturing are unlikely to create a major overhaul of the CDMO space. He doesn’t anticipate the industry entering a new world of full-service third parties, noting that experts continue to extol the virtues of both the full-service (one-stop shop) and specialty-CDMO business models. Proponents of the former option find “value in being able to follow their customers’ progression from R&D to commercial. On the other hand, the specialty CDMOs believe that specializing in just a few capabilities will enable them to differentiate themselves in the marketplace and become preferred suppliers to their biopharma customers.”

Whether Thermo Fisher pursuing the one-stop shop model, or Catalent adding specialist cell-therapy capabilities through MaSTherCell in 2020 (33), Manlapig said, “these prominent transactions result in the industry having some large players and a good number of smaller CDMOs able to compete effectively for business given their nimbleness and less-bloated cost structures.”

He concluded that options are always good for clients. “Perhaps for more straightforward drug-development projects, a one-stop shop model could work to maintain a single touchpoint and expedite the process. Meanwhile for more nuanced projects, working with specialty CDMOs that possess the unique knowledge and capability will be key.”

References

1 Baral S, Ural A. Despite a Downturn in Dealmaking, As Companies Seek To Secure Growth Through Innovation, M&A Will Need To Take a Central Strategic Role. Ernst & Young Global Ltd.: London, UK, 9 January 2023; https://www.ey.com/en_gl/life-sciences/mergers-acquisitions-firepower-report.

2 Stanton D. Shareholders’ Nod Puts $74bn BMS Celgene Merger Back on Track. BioProcess Insider 16 April 2019; https://bioprocessintl.com/bioprocess-insider/global-markets/shareholders-nod-puts-74bn-bms-celgene-merger-back-on-track.

3 Stanton D. Takeda Post-Shire Could Divest 25% of Its Business. BioProcess Insider 8 February 2019; https://bioprocessintl.com/bioprocess-insider/deal-making/takeda-post-shire-could-divest-25-of-its-business.

4 Stanton D. Amgen Looks to the Horizon with $27.8bn Acquisition. BioProcess Insider 12 December 2022; https://bioprocessintl.com/bioprocess-insider/deal-making/beyond-the-horizon-sanofi-bows-out-of-ma-race.

5 Nelson M. Pfizer To Acquire Seagen for $43 Billion. BioProcess Insider 13 March 2023; https://bioprocessintl.com/bioprocess-insider/deal-making/pfizer-to-acquire-seagen-for-43-billion.

6 Amgen Responds to FTC Action Re: Proposed Acquisition of Horizon Therapeutics. Amgen: Thousand Oaks, CA, 16 May 2023; https://www.amgen.com/newsroom/press-releases/2023/05/amgen-responds-to-ftc-action-re-proposed-acquisition-of-horizon-therapeutics.

7 Shepardson D. California, Other States Join FTC Bid To Block Amgen Deal. Reuters 22 June 2023; https://www.reuters.com/markets/deals/california-other-states-join-ftc-bid-block-amgen-deal-2023-06-22.

8 Premerger Notification and the Merger Review Process. US Federal Trade Commission: Washington, DC, 2023; https://www.ftc.gov/advice-guidance/competition-guidance/guide-antitrust-laws/mergers/premerger-notification-merger-review-process.

9 Pierson R, et al. UPDATE 4-Pfizer to Close More Plants, Cut 6,000 Jobs. Reuters 18 May 2010; https://www.reuters.com/article/pfizer-jobs-idUKN1813423120100518.

10 Form 10-K: Pfizer Inc. US Securities and Exchange Commission: Washington, DC, 31 December 2022; https://s28.q4cdn.com/781576035/files/doc_financials/2022/ar/PFE-2022-Form-10K-FINAL-(without-Exhibits).pdf.

11 Stanton D. Big Pharma M&A a Boon for Business, Says Thermo Fisher. BioProcess Insider 30 July 2019; https://bioprocessintl.com/bioprocess-insider/global-markets/big-pharma-ma-a-boon-for-business-says-thermo-fisher.

12 NextPharma and Takeda Announce Future of Pharmaceutical Manufacturing Site in Asker, Norway. NextPharma: London, UK, 6 September 2022; https://nextpharma.com/fileadmin/nextpharma/downloads/press_release_nextpharma_takeda_06092022.pdf.

13 Stanton D. Rentschler Buying Shire Hemophilia Plant in MA. BioProcess Insider 18 December 2018; https://bioprocessintl.com/bioprocess-insider/deal-making/rentschler-buying-shire-hemophilia-plant-in-ma.

14 Stanton D. Catalent To Invest Up to $10m into Ex-BMS Fill/Finish Site. BioProcess Insider 21 June 2019; https://bioprocessintl.com/bioprocess-insider/facilities-capacity/catalent-to-invest-up-to-10m-into-ex-bms-fill-finish-site.

15 Nelson M. Korean CDMO Enters US with BMS Plant Buy. BioProcess Insider 16 May 2022; https://bioprocessintl.com/bioprocess-insider/facilities-capacity/korean-cdmo-enters-us-with-bms-plant-buy.

16 Beutin N, Schmidt H. Current Trends and Strategic Options in the Pharma CDMO Market. PricewaterhouseCoopers GmbH: Frankfurt am Main, Germany, November 2019; https://www.pwc.de/de/gesundheitswesen-und-pharma/studie-pharma-cdmo-market.pdf.

17 Heiber I. Contract Development and Manufacturing Organizations (CDMOs) Are Using M&A To Invest in Technology and Capabilities. EY-Parthenon GmbH: Berlin, Germany, 14 July 2022; https://www.ey.com/en_qa/strategy/how-cdmo-companies-are-leading-innovation-for-pharmaceutical-partners.

18 Nelson M. Recipharm Bolsters Biologics Biz with Vibalogics Buy. BioProcess Insider 21 February 2022; https://bioprocessintl.com/bioprocess-insider/deal-making/recipharm-bolsters-biologics-biz-with-vibalogics-buy.

19 Nelson M. Recipharm Takes First Step in DS Biologics with GenIbet Buy. BioProcess Insider 3 February 2022; https://bioprocessintl.com/bioprocess-insider/deal-making/recipharm-takes-first-step-in-ds-biologics-with-genibet-buy.

20 Nelson M. Asahi Kasei Enters CDMO Biz with Bionova Buy. BioProcess Insider 20 April 2022; https://bioprocessintl.com/bioprocess-insider/deal-making/asahi-kasei-enters-cdmo-biz-with-bionova-buy.

21 Stanton D. Thermo Fisher Going Viral in $1.7bn Brammer Bio Buy. BioProcess Insider 25 March 2019; https://bioprocessintl.com/bioprocess-insider/deal-making/thermo-fisher-going-viral-in-1-7bn-brammer-bio-buy.

22 Stanton D. Catalent Jumps into “Transformative” Gene Therapy Space with $1.2bn Paragon Buy. BioProcess Insider 15 April 2019; https://bioprocessintl.com/bioprocess-insider/deal-making/catalent-jumps-into-transformative-gene-therapy-space-with-1-2bn-paragon-buy.

23 Phosphorex To Establish CGMP Manufacturing for Lipid Nanoparticles with Growth Capital from Ampersand. Ampersand: Hopkinton, MA, 20 August 2022; https://ampersandcapital.com/phosphorex-to-establish-cgmp-manufacturing-for-lipid-nanoparticles-with-growth-capital-from-ampersand.

24 Ascendia Pharmaceuticals Secures Growth Equity Investment from Signet Healthcare Partners. PR Newswire 8 April 2021; https://www.prnewswire.com/news-releases/ascendia-pharmaceuticals-secures-growth-equity-investment-from-signet-healthcare-partners-301265086.html.

25 Stanton D. Sartorius To Add CGT Reagents Through $2.6bn Polyplus Buy. BioProcess Insider 31 March 2023; https://bioprocessintl.com/bioprocess-insider/upstream-downstream-processing/sartorius-to-add-cgt-reagents-through-2-6bn-polyplus-buy.

26 Burger L. Germany’s Merck To Buy Sigma-Aldrich for $17 Billion To Boost Lab Supplies Operation. Reuters 22 September 2014; https://www.reuters.com/article/us-merck-sigma-aldrich-idUSKCN0HH1CK20140922.

27 Stanton D. Cytiva Rises Out of GE Healthcare as Danaher Completes $21bn Deal. BioProcess Insider 1 April 2020; https://bioprocessintl.com/bioprocess-insider/deal-making/cytiva-rises-out-of-ge-healthcare-as-danaher-completes-21bn-deal.

28 Thermo Fisher Scientific Completes Acquisition of Patheon. Thermo Fisher Scientific Inc.: Waltham, MA, 29 August 2017; https://www.prnewswire.com/news-releases/thermo-fisher-scientific-completes-acquisition-of-patheon-300510547.html.

29 Macdonald G. Thermo Fisher To Buy PPD To Build in “High Growth” Clinical Services Sector. BioProcess Insider 19 April 2021; https://bioprocessintl.com/bioprocess-insider/deal-making/thermo-fisher-to-buy-ppd-to-build-in-high-growth-clinical-services-sector.

30 Nelson M. Merck KGaA To Acquire Exelead in $780m Deal. BioProcess Insider 7 January 2022; https://bioprocessintl.com/bioprocess-insider/deal-making/merck-kgaa-to-acquire-exelead-in-780m-deal.

31 Stanton D. Danaher Entering Pureplay CDMO Space in $9.6bn Aldevron Buy. BioProcess Insider 18 June 2021; https://bioprocessintl.com/bioprocess-insider/deal-making/danaher-entering-pureplay-cdmo-space-in-9-6bn-aldevron-buy.

32 Stanton D. Danaher Reportedly Drops Catalent Courtship, but Is CDMO Acquisition Imminent? BioProcess Insider 19 April 2023; https://bioprocessintl.com/bioprocess-insider/deal-making/danaher-reportedly-drops-catalent-courtship-but-is-cdmo-acquisition-imminent.

33 Stanton D. Catalent To Buy Orgenesis’ Cell Therapy CDMO Biz for $315m. BioProcess Insider 3 February 2020; https://bioprocessintl.com/bioprocess-insider/deal-making/catalent-to-buy-orgenesis-cell-therapy-cdmo-biz-for-315m.

Dan Stanton is founder and managing editor of BioProcess Insider, [email protected]. Paul Manlapig is a director at Wombat Capital and leads the firm’s Biopharma CDMO Mergers & Acquisitions practice, [email protected].

You May Also Like