Biopharmaceutical Contract Manufacturing Technology and Capacity Investments

September 15, 2016

WWW.WACKER.COM

The market for biopharmaceutical contract manufacturing has shown robust growth over the past few years. The continuing growth of biopharmaceuticals and the increase in new and novel drug projects entering clinical pipelines are fueling the market’s double-digit growth rate. Responding to these new demands, contract manufacturing organizations (CMOs) are expanding both their capabilities and capacities.

Background

Information presented here draws from recent interviews with six executives at biopharmaceutical contract manufacturing organizations, and from HighTech Business Decisions’ latest report, Biopharmaceutical Contract Manufacturing: Improving Markets, Services and Technologies. That report uses primary research from senior-level executives and scientists at pharmaceutical and biotechnology companies and CMOs. For purposes of this article, HighTech Business Decisions defines biopharmaceuticals as complex molecular structures created through the genetic manipulation of living cells or organisms used for therapeutics, diagnostics, or vaccines.

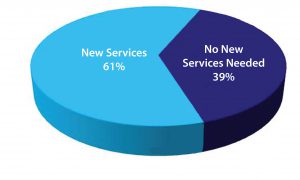

Figure 1: Pharmaceutical and biotechnology companies seeking new services

New Services Sought from CMOs

The biopharmaceutical contract manufacturing industry is currently experiencing double-digit growth rates and robust demand for its production, development, and

analytical services. As mentioned above, the greater demand for biopharmaceuticals combined with new drug products entering clinical pipelines drive the demand for contract manufacturing. From HighTech Business Decisions’ study, most pharmaceutical and biotechnology companies are looking for additional services from their CMOs (Figure 1).

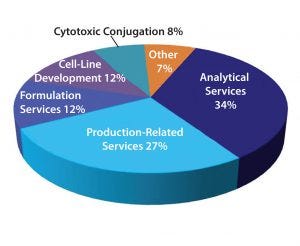

Figure 2: New services sought by pharmaceutical and biotechnology companies

The mix of services sought includes analytical, formulation, and cell-line development along with production-related services (Figure 2). Product sponsor companies continue to need production services such as large- or small-scale production capabilities, downstream purification, and one-stop-shop services. Other services sponsor companies want include formulation services, cell-line development, and cytotoxic conjugation. The reasons for outsourcing those services vary, but some common trends have emerged, including not wanting to invest in-house for services that are already available from a CMO, use of a CMO that has the requisite specialized knowledge, and the need for good manufacturing practice (GMP) manufacturing capabilities. Some pharmaceutical and biotechnology companies also have outsourced analytical work to specialized laboratories rather than to CMOs. The reason for that appears to be economic.

What Respondents Say: Below are a few comments from respondents in our study who have highlighted some of their outsource needs, all comments from different professionals at pharmaceutical or biotechnology companies.

We may outsource certain processes that we are trying to develop. We won’t try to reinvent the wheel in house if there is a CMO that already has a specific assay in place. Typically, we may outsource cell-line development and formulation at a CMO, one whom we know can do this for us. We prefer to keep in-house those processes that we manage and operate best.

We find we go to the CMO for analytical development a lot. The specialty house offers more for the money. We have the sense that some CMOs use analytical development as a money generator. Formulation development is something we do in-house that we are seeking outside.

We are looking for analytical method development. It becomes quite a complicated exercise. And as the number of products in the pipeline increases, both method development and method validation are areas where we could use a lot of help.

We have R&D laboratories, but nothing GMP. We’re keeping those people more focused on the research stage, and we have more going on in research. The amount of work has grown in research, so we have less time to spend on development. We have a trend of outsourcing more development activities. For example, earlier this year, for the first time, we outsourced cell-line development. We had done that piece in-house previously.

All of our stuff is done outside. The antibody piece of the supply chain is pretty well established. We do some cell engineering. So people who can offer the capacity to do cell engineering and go to some nonstandard systems are of interest. We’re willing to do a little bit of development work upfront for an engineered antibody. Beyond that, we are looking for people who can handle high-potency conjugates.

Although over half of the pharmaceutical and biotechnology companies are looking for new services from CMOs, a significant minority of respondents reported no need for new services. Most of these respondents mentioned having in-house capabilities and therefore do not need new outside services. Many respondents with in-house capabilities do not outsource those services because their projects require specialized capabilities that are not generally available from CMOs. Other pharmaceutical and biotechnology respondents also noted that they have outsourced all services they require and need nothing else.

What Respondents Say: Other reasons given for not seeking new services from a CMO include a slowdown in a project or a change in company focus. Below are comments from different respondents (all from pharmaceutical and biotechnology companies) who do not need new outsource services.

There are usually no new services that we are seeking. In fact, we in-source far more than we outsource. We sometimes outsource programs if there is something that is lacking while we develop it in-house, unless it is a one-off program, which we may outsource fully.

There are no new services conducted currently in-house that we seek to outsource, because our technology targets . . . [are] very unusual compounds. So we have to run all assays in-house. We are the only ones who know how to do these.

We are moving in the opposite direction because we are internalizing more services that we once outsourced. We will still outsource stability testing because of constraints, but this will not increase in the future.

Figure 3: Technology areas of investment

Investment in New Technologies

According to the study, more than half of the CMOs plan to invest in capacity (including single-use capacity) to meet their clients’ needs. The mix of investment categories shows that process improvement and capacity expansions are the major areas of investment for the industry (Figure 3). CMO investment in single-use technology includes both upstream and downstream processes, such as bioreactors and purification technology.

Other areas where CMOs are investing in new technologies include expanding the breadth of their platforms, developing new and improved expression systems with more effective biology, and expanding fill-and-finish capabilities. To a lesser extent, other areas of new technology investments include perfusion and continuous-feed bioreactors, formulation and lyophilization development technology, and microbioreactors. The investment in microbioreactors is expected to both improve and speed-up biopharmaceutical development.

Examples of CMOs Offering New Services and Expanded Capacity

Executives from the CMOs note several investments made by their organizations to meet the needs of their clients. As mentioned by Tony Hitchcock, technical director at Cobra Biologics, “In the past few years, Cobra (like many CMOs) has seen a very significant increase in demand for both development and manufacturing services across all product areas, including antibody-based therapies and gene therapies.”

Similarly, Biotechpharma UAB has expanded both its analytical capabilities and production capacity. It has added new mass spectrometers and a ultraperformance liquid chromatography (UPLC) system. “Both will help to strengthen our capabilities in antibody and recombinant protein-analysis and thereby support process development activities,” said Andre Markmann, vice president of business development. “Those additions go hand-in-hand with thorough analytical testing needed to understand the effect that certain process-parameter variations have on product purity.” In addition, Biotechpharma recently expanded its mammalian cell culture manufacturing capacity by adding a 2,000-L mammalian suite.

Another example of CMOs investing in additional service offerings is Goodwin Biotechnology, which has expanded its capacity in antibody–drug conjugates (ADCs) and analytical testing. “To meet the increasing demand in conjugating highly cytotoxic products (e.g., anticancer drugs) to enhance the efficacy of ADCs, we have established a dedicated ISO-7 cytotoxic process cleanroom for proof of concept, process development, toxicology, and CGMP manufacturing,” said SooYoung Lee, PhD, chief operating officer. In addition, Lee noted, “We have developed proprietary processes to overcome the challenges associated with random conjugations with site-directed conjugation of radionuclide chelators and other payloads and ligands to antibodies that results in narrower drug-to-antibody mole ratios (DAR), improved conjugate binding, and an enhanced therapeutic index.” Lee also mentioned that Goodwin continues to update its analytical capabilities in capillary electrophoresis–sodium-dodecyl sulfate (CE-SDS) and capillary isoelectric focusing (cIEF) testing. Goodwin has recently added a 200-L single-use bioreactor and an ATF6 perfusion system to increase its biopharmaceutical manufacturing capacity.

To serve its customers with very small or highly insoluble molecules that require in vitro refolding and cannot be manufactured in a soluble state, Wacker Biotech GmbH has developed a refolding toolbox termed FOLDTEC. “It includes highly productive host strains, is phage- and antibiotic-free, and benefits from the profound scientific experience in industrial-scale refolding,” said Thomas Maier, managing director. He noted that the recent improvement in Wacker Biotech’s Escherichia coli secretion technology (branded as ESETEC 2.0) enables massive release of fully functional biopharmaceuticals (e.g., 5 g/L antibody fragments) to culture media while leveraging significant cost advantages and time savings of microbial systems. “We offer comprehensive technologies for cost-efficient production of biopharmaceuticals with microbial systems.” Recently, Wacker Biotech successfully scaled-up this process for the manufacture of an antibody fragment for MedImmune.

Expanding capacity in Europe and Asia, Boehringer Ingelheim Biopharmaceuticals recently announced a significant investment at its existing microbial site in Vienna, Austria, for large-scale mammalian cell culture biopharmaceutical production. “With this expansion, we can serve the growing large-volume product demands of our customers in indications with unmet medical need, — especially for monoclonal antibodies technology — as we continue to be a reliable supply partner for them,” explained Barbara Esch, head of marketing, communications and business intelligences. “We have also expanded our global footprint with the addition of a full-service, flexible, fully-disposable GMP facility in Shanghai, China. With this expansion, we are the first international biomanufacturing CMO supporting the emerging Chinese biotechnology market as well as customers worldwide.” Esch noted that her company’s Shanghai facility started manufacturing activities in 2015. The facility started with a focus on clinical material supply for customer projects. The company continues to invest in that facility, which will begin production of commercial-phase biopharmaceuticals by the beginning of 2017.

Patheon is the final example of a CMO that is making investments in process improvements. John Ward, vice president of engineering, noted “We have been an avid early adopter of multiple single-use technologies. Recently, we implemented the use of flocculation combined with depth filtration to increase depth-filtration loading, product recovery, and facility fit. In addition, we are using prepacked columns, which allow for faster suite turnover and reduce the need for column change-over between customers.” Patheon also continues to invest in analytical technologies. “On the analytical side, we are implementing the use of SoloVPE variable-pathlength extension analysis (from C Technologies) for increased speed for in-process concentration monitoring,” said Paul Jorjorian, global director of technology transfer. The company is also exploring hybrid solutions (combination of stainless steel and single-use technologies) as part of its efforts to debottleneck existing facilities. Patheon has recently implemented additional bioreactors and downstream suites online at its manufacturing facilities. “We continue to plan for additional expansion at all of our biologics sites to prepare for new business. The exact timing is driven by customer requirements,” said Ward.

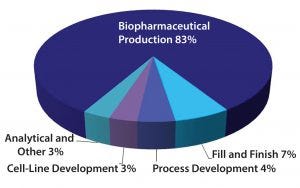

Figure 4: Biopharmaceutical market by service offering

An Expanding Industry

Sponsor companies are placing great demands on CMOs. Development and analytical services continue to be a growing (albeit small) component of the biopharmaceutical contract manufacturing market. Currently, the production of biopharmaceutical drug substances now accounts for 83% of the biopharmaceutical contract manufacturing market (Figure 4). Most other revenue generated by CMOs is mainly for process development and cell-line development services. Furthermore, some CMOs — in an effort to offer one-stop-shop services — also provide fill-and-finish services. However, that represents a small fraction of the contract fill-and-finish market for biopharmaceuticals. CMOs that specialize in the production of drug products continue to provide the majority of fill-and-finish services for large-molecule drug products. With continued investment by the pharmaceutical and biotechnology companies for new and novel biopharmaceuticals, CMOs will continue to expand their capabilities and capacities to meet their customers’ needs.

William Downey is the president of HighTech Business Decisions, a market research and consulting company that has been publishing reports on the biopharmaceutical contract manufacturing market since 1997. For more information, visit www.hightechdecisions.com or call 1-408-978-1035.

You May Also Like