China’s Biopharmaceutical Companies Target Global Markets

ADOBE STOCK (HTTP://STOCK.ADOBE.COM)

Global perspectives of China as a major biopharmaceutical supplier have changed over the past decade. In 2008, BioPlan Associates completed its first analysis and directory of the top 60 biopharmaceutical facilities in China (1). Based on findings from our study titled Advances in Biopharmaceutical Technology in China (2), we found that China clearly held the image of a low quality manufacturer of biogeneric products almost exclusively for its domestic market. Further, concerns over intellectual property protection, contracting problems, and management issues all created an impermeable barrier to biologics manufacturing in China.

Today, due in large part to substantial investments in bioprocessing quality management, hiring and training of staff, and attraction of talented industry staff from abroad, China’s bioprocessing capabilities have grown quickly and substantively from that low baseline presented in our earlier study. Our report, Top 60 Biopharmaceutical Facilities in China, released earlier this year (1), quantifies much of the recombinant human biologics capacity in China. It also demonstrates investments in modern good manufacturing practice (GMP) facilities by highlighting the active build-out of capacity, which is slated to continue at least over the next two to three years. However, China still has a lot of catching up to do simply to make the number of biological drugs needed to support China’s rapidly developing domestic markets.

A number of facility expansion plans are slated to incorporate some of the most modern single-use technologies (SUTs) and modular strategies. Although most of the largest-scale new facilities will be based on stainless steel equipment, adoption of single-use strategies initially will help to get new local and international facilities commissioned quickly and begin manufacturing. So it is gaining popularity quickly in newly founded small- to medium-sized biotechnology companies in China. However, as in the United States and European Union, SUTs alone probably will not be sufficient to meet production demand, and they will not be effective at the megasized facilities that China may need to support its domestic markets.

In comparing China with global bioprocessing ranking, we find from research on our top 1,000 global biopharmaceutical facilities index (www.top1000bio.com) for example, that Genentech/Roche Taus, Singapore ranks 60th by capacity (total bioreactor volume) worldwide, with an estimated 85,000 L. That single Singapore facility equates to ∼20% of China’s total bioprocessing capacity today. We also note that total estimated capacity for the top 60 worldwide facilities is ∼9.7 million L. And of all facilities, the top 6% have 57% of estimated total worldwide capacity.

Making the Leap to Global Bioprocessing

In a recent survey of 50 Chinese members of our Biotechnology Industry Council (BIC) panel of bioprocessing experts (3), we asked how and when China will fill the gap to become a global hub for bioprocessing. Domestic manufacturers recognize clear gaps in its capabilities necessary to become a global player.

China-based biomanufacturers recognize their capability deficiencies in operational and functional areas. And they are actively investing today, with the intent of emerging as a global biopharmaceutical hub over the next 10 years. We found substantial optimism among Chinese biopharmaceutical professionals. They believe that their country can and will fill the quality gap between its current production operations and the more rigorous GMP quality processes in the United States, European Union, and other regions with more established biopharmaceutical industries, stricter guidelines and enforcement of GMPs, quality control, and documentation.

Nearly 90% of responding Chinese biologics managers indicated that their companies currently plan to target global distribution of GMP-produced biologics within 10 years. To achieve that goal, many recognize that global industry participation requires China to address its facility-level GMP deficiencies.

Survey Respondents Weigh In |

Some survey participants remarked on what they thought China will need to succeed as a top global biomanufacturing center. “Improved law and regulatory system and strict enforcement of existing laws; government sponsorship of national medical insurance plan and increased purchasing power of medical services/products in China for Chinese residents; and training for professionals in the biopharmaceutical sector.” “US/EU CGMP-compatible biologics manufacturing; innovative biological therapeutics targeting unmet clinical needs; and highly experienced bioprocessing and management team.” “More investment in the field, continuous funding support; good domestically manufactured production equipment (currently China relies on imported devices and consumables); highly trained professionals, including experts in key technologies and open-minded, forward-looking management teams.” “Capability to really innovate and develop globally recognized monoclonal antibodies (MAbs), bispecific MAbs, antibody–drug conjugates, and so on; more collaboration between research organizations and contract manufacturing organizations (CMOs) to speed up commercialization while reducing waste of resources in redundant manufacturing facilities; government support; and national medical insurance.” “More innovative projects and a mindset that is focused on innovation.” “Attract top talent and staff in product development, especially in GMP manufacturing and quality. Give the talent the respect and freedom to operate within the company and more independent R&D management. Chinese biopharmaceutical companies need to modernize their business management approaches away from a traditional ‘one size fits all’ approach so that individual excellence and substantial contributions can be encouraged and rewarded. Chinese companies need to make business decisions based on long-term prospects, not just short-term goals.’ “Improvements in the regulatory system to be more consistent with the International Council on Harmonization (ICH), US Pharmacopeia (USP), or FDA requirements and overall improvements in professionalism of the industry.” |

Attributes Important Now

To define what China must do today to achieve global success by 2026, we asked executives at Chinese biopharmaceutical facilities to evaluate their domestic industry’s prospects.

Figure 1: Top “strength” attributes required for China’s biologics companies to expand globally (selected responses from BioPlan Associates’ China Global Biopharma Center survey, December 2016)

Study respondents first identified the top five “strength” attributes most important to China if it is to expand its presence in global biopharmaceuticals. Of the 17 attributes cited, the five most commonly cited as required by Chinese facilities to compete globally are

More innovative biopharmaceutical pipeline

Overall “quality image”

Commercial-scale capacity

Scientific and technical expertise

Compliance track record and expertise.

Over half (58%) cited the Chinese biologics industry as “requiring more innovative biopharmaceutical pipelines.” These shortcomings relate directly to China’s limited R&D investments, a small domestic R&D pipeline, and especially insufficient funding of early stage research on products and platforms. We expect investments in those areas to increase over the next 10 years.

The second most cited area required for China to be considered a global biopharmaceutical manufacturing center was a better overall “quality image,” as noted by half (50%) of respondents. Many facilities are investing in the quality management and systems expected of GMP manufacturers, so the quality image is likely to evolve over time.

Future Success

To refine our critical gap analysis, we asked survey respondents to discuss the specific actions that should be taken to ensure that China strategically develops as a hub for global biopharmaceutical manufacturing. This question helps define Chinese bioprocessing executives’ perceptions of where their facilities must invest today to ensure that they and this segment become a global competitor.

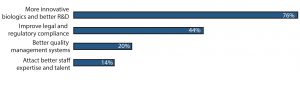

Figure 2: What China needs to succeed as a global biopharmaceutical center in 10 years (selected responses from BioPlan Associates’ China Global Biopharma Center survey, December 2016)

Over three-quarters of respondents to this open-ended question mentioned that having the ability to develop more innovative, fully novel biological products with better R&D competence will help establish global competitiveness within 10 years. Typically, biological products require a heavy investment in R&D, which can take decades of development. Thus, the long-term goal of 10 years will require substantial investment in areas such as

Developing more innovative biologics and better R&D (76% of respondents)

Improving legal and regulatory compliance (44%)

Incorporating better quality management systems (20%)

Attracting better staff expertise and talent (14%).

Other key areas included improved quality image, more government funding and investment, government sponsored national medical insurance plans, 12% more investment/capital, better commercialization, modern business management, professional training, enforcement of existing laws, clinical research standardization, and data integrity.

Path to Exporting Biologics to Major Markets

We asked our BIC respondents to indicate their facility’s primary market objectives for biologics production, today and in 10 years. We found that currently, 70% of Chinese biopharmaceutical facilities are primarily focused on production for domestic consumption. Fast-forward 10 years, and the majority (86% of China’s biopharmaceutical industry respondents) project that they will be manufacturing for exports.

China often has been cited as having more expertise and being more GMP-capable than other Asian countries. With its investment in bioprocessing, Chinese biomanufacturing ultimately, within 10–20 years, could compete effectively in major markets including the United States, Europe, and other areas in Asia such as Singapore and Korea. China appears to be on track eventually to assume a major position in Asian biomanufacturing, surpassing India. However, it will take 5–10 years or more years of efforts to catch up with South Korea and Singapore in terms of its current GMP manufacturing capacity.

Plans for Future Opportunities

Chinese domestic demand for biopharmaceuticals has been increasing, by various estimates, between 15–20% annually. This is partly a result of rising incomes, a growing middle class, greater health insurance coverage, and products becoming more widely available. As Chinese companies ramp up operations to serve emerging domestic markets more effectively, this experience will facilitate entry into Western biopharmaceutical markets as well. A similar path is being taken for biosimilars. Some Chinese companies are focusing on development of follow-on biologics in an effort to produce GMP-quality products at a fraction of the Western reference products’ prices, which can help future sales in Western markets.

China continues to take steps toward aligning with global GMP requirements. However, it is not currently (and unlikely in the future to be) among the very lowest-cost destination countries for biopharmaceutical manufacturing.

The Chinese biopharmaceutical industry appears to be investing in long-term global opportunities in biologics, especially in bioproduction. Our current BIC study shows that domestic Chinese manufacturers have rational expectations about what is needed in terms of investments in R&D, quality and regulatory systems, infrastructure, intellectual property reform, healthcare investment, and workforce development. The industry is focusing first on its domestic markets and exports to lesser-regulated international markets. That is likely to support its quality management systems and future global position in biologics. Global investors and partners with the foresight to develop relationships with Chinese biopharmaceutical manufacturers will share in China’s future bioprocessing successes.

References

1 Top 60 Biopharmaceutical Facilities in China. BioPlan Associates, Inc.: Rockville, MD, March2017.

2 Advances in Biopharmaceutical Technology in China. Society for Industrial Microbiology and BioPlan Associates, Inc. 2008.

3 China’s Advances in Global Biopharma and Bioprocessing: A 10-Year Projection in Need for Innovation and Quality Improvements. White Paper Survey of 50 Chinese Biopharmaceutical Executives. BioPlan Associates, Inc. Rockville MD, January 2017; www.bioplanassociates.com.

Vicky Qing Xia is project director, Leo Cai Yang is project manager, and corresponding author Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm in Rockville, MD; [email protected]; 1-301-921-5979; www.bioplanassociates.com.

You May Also Like