Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

March 1, 2008

Bioassays are required for a variety of purposes in the development and production of biopharmaceuticals including drug candidate selection, product releases, product stability assessment, and comparability to support proposed process changes. However, because of their complexity and susceptibility to many variables, bioassays often prove problematic and difficult to develop. Timely development of suitable assay systems represents a major investment on the part of the biopharmaceutical industry — but late development often results in even more costly clinical holds.

PRODUCT FOCUS: All biologics

PROCESS FOCUS: Product testing

WHO SHOULD READ: ANALYTICAL, PRODUCT DEVELOPMENT, QA/QC, regulatory affairs, formulations

KEYWORDS: bioassays, immunoassays, functional assays

LEVEL: BASIC

Recent and ongoing advances in biology and technology provide the possibility of new types of assay systems and readouts. Some offer significant logistical and scientific advantages so that, in addition to being investigated for new products, they are increasingly being considered as replacements for some existing bioassays.

To identify some of the specific concerns and new emerging technical trends, we ran surveys on bioassay use at the 2004 and 2005 IBC European Biological Assays conferences. Results of the latter survey were published in BioProcess International in 2006 (1). They highlighted the importance of cell-based bioassays to the biopharmaceutical industry. So we circulated a second survey (concentrating more on cell-based bioassays, particularly their use in potency measurement) among delegates and speakers at the 2006 IBC European Biological Assays conference (Munich, Germany, 16–18 October) and at the 2007 IBC International Intensive Symposium on Biological Assay Development and Validation (Boston, MA, 23–25 April). The results are published here to provide data on current and planned use of cell-based bioassays in the industry.

FRANKLIN CARRERO (WWW.SXC.HU)

Methods

We distributed a survey comprising nine questions about different aspects of bioassay use (with particular emphasis on cell-based assays for potency measurement) among the delegates at two international conferences on biological assays: in Europe, the 2006 IBC European Biological Assays conference (108 delegates representing 71 organizations in 17 countries) and in the United States, the 2007 IBC Biological Assay Development and Validation Symposium (218 delegates representing 101 organizations in 15 countries). We asked those delegates who participated

to complete the survey forms anonymously

to collaborate and submit only one form per organization if colleagues from the same organization were present

to return a form even if they were from organizations for which the survey questions were inappropriate, and if that were so to indicate it

and at the US conference only, to indicate whether colleagues from their company had attended the European conference.

When the surveys were handed out, a presentation was made to explain the intended purpose of each question and how the answers should be formulated. Particular requirements for answering specific questions and particular constraints in formatting the results are indicated against the relevant tables in the “Results and Discussion” section below. We presented our questions in the survey in the same sequence as they are reported here. The tabulated results for each question are in similar format to that of the question, although some adaptation proved necessary.

Results and Discussion

From the European meeting, 33 survey forms were returned, including two from consultants, one of which gave no details and one of which gave only company details (which are included in Table 1A). Responses from the remaining 31 survey forms are reported in Tables (23456789). From the US meeting, 44 survey forms were returned, including one from a patent office (shown in Table 1B). Responses from the remaining 43 survey forms are reported in Tables (23456789). As to whether a colleague from the company had attended the 2006 European meeting, 30 reported “no,” 10 said “don’t know,” and one said “yes.”

Table 1A: Companies reporting at the European meeting (32 responses)

Table 1B: Companies reporting at the US meeting (44 responses)

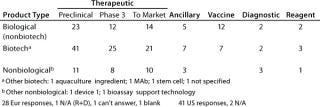

Table 2A: Product type (number of companies with products of each type and each stage of development)

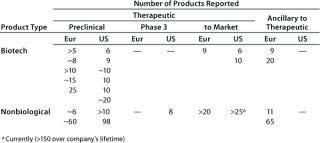

Table 2B: Individual reports of the number of products (greater than 5) in one category and at one stage of development

Table 3: Assay systems used (number of companies reporting each type of assay system); 31 Eur responses, 43 US responses

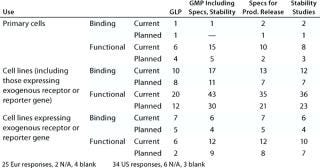

Table 4A: Established cell-based assays (companies reporting current or planned use)

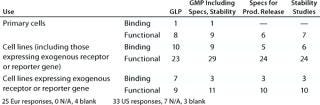

Table 4B: Cell-based assays under development (number of companies reporting)

Table 4C: Binding assays with whole cells (number of companies reporting)

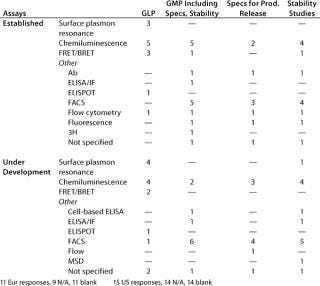

Table 5: Binding assays without whole cells (number of companies reporting use)

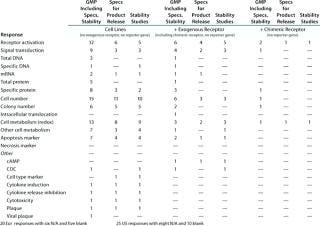

Table 6A: Established functional assays using cell lines for GMP (no reporter gene), number of companies reporting use

Table 6B: Established functional assays using cell lines for GMP with reporter gene (individual responses shown with number of assays per company per category, X indicates a positive response); six Eur responses with seven N/A and 18 blank; two US responses with 17 N/A and 24 blank

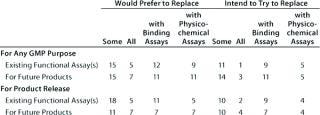

Table 7A: Replacement of functional bioassays (number of companies reporting preference or intention); 22 Eur responses with one N/A and eight blank; 25 US responses with seven N/A and 11 blank

Table 7B: Companies that have replaced functional assays (number reporting); five US responses

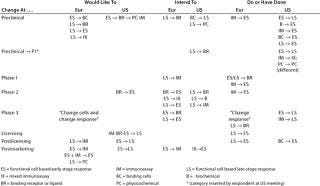

Table 8: Change of cell-based functional assay for product release postlicensing to (number of companies reporting)

Table 9: Change of assay system during product development (individual responses showing the assays involved and the direction of change are reported); 16 Eur responses with three N/A answers, one “don’t know,” and 11 blank; 17 US responses with 10 N/A, 16 blank

After we examined the responses tabulated separately for the two meetings, we decided that, because relatively few companies were likely to be represented twice, we would combine the majority of our data from the two meetings and include comments on any noticeable differences between the two regions. In the tables, “EU” denotes data from the European meeting, and “US” from the US meeting. Separately tabulated results are available on request from the authors.

The number of responses to questions (or parts thereof) and points of particular interest are noted in the tabulated results for each question. Some responses reported under the heading “other” appear similar to one of the listed categories. However, to minimize any influence from our interpretation, we generally show such responses with descriptions as reported on the forms.

Question 1, The Companies: At the European conference, as might be expected, European companies were the most strongly represented. Early development and production were the businesses most highly represented, and 12 companies (of which 11 have a European primary location) carry out both early development and production. At the US conference, again as expected, US companies were the most strongly represented. Here also, early development and production were the businesses most highly represented, and 20 companies (of which 13 have a US primary location) carry out both early development and production.

Question 2, Product Type (Number of Companies with Products of Each Type and in Each Stage of Development): At the European meeting, 28 of 31 companies reported having products. We asked for the number of products at each stage, if known, and 18 companies provided at least some data, but the values include estimates and ranges. Therefore, rather than the number of products in each stage, we report the number of companies with products at each stage. At the US meeting, 41 of 43 companies reported having products, with 28 of them providing some numbers.

From both meetings, companies with therapeutic biotechnology products in preclinical development were the most highly represented. In some categories, the number of products reported spans a wide range, so the cases where companies reported more than five products in a given category at a particular stage of development are summarized in Table 2B.

Question 3, Assay Systems Used: Cell-based functional assays and immunoassays are the most widely used assay systems. Some methods reported as “other” could probably have been classed in a listed category had further details been given. Six companies at the European meeting and twelve at the US meeting reported having therapeutic products on the market but did not report using any physicochemical assays. It therefore seems likely that the use of physicochemical assays has been underreported here.

Question 4, Cell-Based Assays: We asked for a distinction to be made between functional and binding assays here. An assay is described as functional if any step involves a functional biological response — not simply binding to a receptor or antibody. A functional assay may involve multiple steps and include a binding or immunoassay step within it. A binding assay does not involve measurement of any cellular biological response. Some companies did not report numbers here, and others included estimates and ranges, so we report the results as the number of companies with products at each stage.

Question 4A, Established Cell-Based Assays (Current and Planned Use): Both surveys showed that although primary cells are used for GLP and GMP assays (and companies do plan to continue using them), cell lines are far more widely used. Companies reported the use also of genetically modified cell lines expressing exogenous receptors and/or reporter genes for GMP and for product-release assays. Response distribution was broadly similar in the two surveys except that, from the US meeting, no companies reported the planned use of “cell lines expressing exogenous receptor or reporter genes” for binding studies.

Of those reporting the current or planned use of “cell lines expressing exogenous receptors or reporter genes,” six companies from the European meeting and two from the US meeting reported no use of “cell lines (including cells expressing exogenous receptor or reporter gene),” so we believe that the general category of cell lines is probably underreported here.

One report from the US meeting raised the interesting case of a stem cell product. It is tested in assays measuring a functional response of the stem cells and in assays measuring binding. In other words, the product itself is behaving as the cell-based bioassay system would in a classical bioassay. Although it is debatable how this situation fits in with the normal classification of a bioassay, there is no doubt that many issues arising with classical bioassays will be relevant to such assays for this type of product.

From the US meeting, two companies reported use of assays for “other” purposes, namely R&D (under the category of “cell lines/cell lines expressing exogenous receptor or reporter gene, functional, current use”) and comparability/characterization (category: “functional; primary cell, current; cell line, planned”). No category “other” was offered on the survey form here, so it is probable that other companies may not have reported similar further uses.

Question 4B, Cell-Based Assays Under Development: Again, whereas some companies reported the use of primary cells in as

says under development, more reported the use of cell lines. Genetically modified cell lines expressing exogenous receptors and/or reporter genes represent a significant proportion of those being used. Both functional and binding assays are under development, but more companies reported the development of functional assays.

Question 4C, Binding Assays with Whole Cells: A range of different binding assay systems using whole cells was reported for both established assays and for those under development.

Question 5: Binding Assays Without Whole Cells: Here we were concerned with assays in which an analyte binds to at least one component that is not an antibody. In other words, this question excludes immunoassays in which only antibodies are involved in binding to an analyte, but it includes the so-called “mixed immunoassays” in which an analyte binds to a receptor, binding protein, or other molecule in addition to an antibody.

Here as for question 4C, a range of different assay systems was reported for both established assays and those under development. In general, the number of different assays reported by any one company in any one category was less than 10, although one company in the US meeting survey reported about 20 assays in the category established/receptor/ELISA for the purposes of “any GMP” and “specifications.”

Question 6, Established Functional Assays Using Cell Lines for GMP Purposes (6A without a reporter gene; 6B with a reporter gene): Table 6A shows the number of companies reporting using various categories of cell-line–based assays without reporter genes. Because a relatively small number of companies reported using cell-line–based assays with reporter genes, Table 6B shows the individual responses, indicating wherever it was provided the number of different assays used by each company. At the European meeting, six companies reported using reporter gene cell-line–based assays for GMP purposes. The readouts were not specified except for one that proved illegible. At the US meeting, two companies reported using such assays, one specifying that a luciferase reporter gene was used. Both those companies stated that no colleague from the company had attended the European meeting.

Question 7, Replacement of Functional Assays: We wanted to know whether respondents would like to replace, intended to replace, or had replaced functional bioassays for any GMP purpose (or for product release) with binding or physicochemical assays. We further sought to establish whether the same applied to some or all existing assays or those for future products. The majority of companies responding indicated a preference for replacing at least some functional bioassays, though few (two from the European meeting and five from the US meeting) had already done so.

Of the 22 responses from the European meeting, three replied with an overall “no” to the question of replacing functional bioassays, whereas 19 companies would prefer or intend to replace, or have replaced some categories of functional bioassay. Of the 25 US responses, five replied with an overall “no” to the question, and 20 companies stated that they would prefer, intended to, or had replaced some categories.

For this question, a number of responses appeared incomplete: In particular, several companies stated that they would like to replace functional assays but not with what, and some that reported intending to replace assays did not state explicitly that they would prefer to do so. Concerning those that have replaced functional bioassays, from the European meeting two reported having done so already. One reported having replaced some assays in the category “for any GMP purpose” but did not specify whether it/they were replaced by binding or physicochemical assays. The second reported replacing either some or all (unclear) of its functional bioassays under the categories “for any GMP purpose” and “product release” with binding assays(s).

From the US meeting, five companies reported having replaced functional bioassays. Four of these stated that no colleagues had attended the European meeting. A representative of the fifth company did attend the European meeting, but with the anonymous forms, it is impossible to determine whether results from this company are reported in the two surveys. This company reported having replaced some functional assays for future products but did not specify with what.

Question 8, Change of Cell-Based Functional Assay for Product Release Postlicensing: Although changing a release assay after product licensure usually requires considerable work, developments in the bioassay field can offer new systems with considerable logistical advantages, which does make it an attractive possibility. From the European meeting, 12 companies stated that they would like to replace some assays, six intended to, and one had done so. From the US meeting, 13 companies stated that they would like to replace some assays, five intended to, and five had done so. One company reported changing to a different “set-up/calculation.”

Question 9, Change of Assay System During Development: Many changes and additions to assays would be expected during product development, especially at the early stages, and some companies noted that assays had been added rather than substituted. Our aim with this question was to reveal whether there were any general trends in assay substitution. Few respondents indicated both the assay systems and direction of change, and only the responses that did so are reported in Table 9. From the European meeting, several responses indicated changing from in vivo assays to other systems. However, their responses are not included because this category was not included in the question. So other companies may not have reported a similar change.

Noticeably, for some assay systems (such as immunoassays and early and late-stage cell-based functional bioassays), although some companies reported wishing/intending/having changed from a system, others listed changing to that same system. It is interesting to note reports of changes from early stage assays to late-stage, for example, because it is frequently stated that the tendency is in the opposite direction.

Our Conclusions from this 2006–2007 Survey

Results of our combined 2006–2007 survey demonstrate a wide variety of different cell-based assays currently used in the biopharmaceutical industry. Assays under development indicate possible trends for the near future. As we noted in our 2005 survey report (1), caution must be exercised in interpreting or extrapolating these results because of the limited size of the survey as well as possible sources of geographical bias and selection of companies represented at the conferences. However, by combining results from the 2006 meeting in Europe and the 2007 meeting in the US (thus reducing some of the geographical bias), we obtained 74 responses from what should be different biopharmaceutical companies because efforts were made to reduce and assess the possibility of multiple reporting from a single company.

This report provides data on some hotly debated issues, including the use of genetically engineered cell lines, postlicensing bioassay changes for release testing, and the possibility of substituting a functional bioassay for potency measurement by a binding or physicochemical assay. Most of the data are reported here in fairly raw form so that readers can extract the information of interest to them. In summarizing and tabulating the results, some information is inevitably lost, so those who are particularly interested in specific issues are invited to contact the authors directly.

1.) Robinson, CJ. 2006. A Survey of Bioassays in the Biopharmaceutical Industry. BioProcess International 4:24-36.

You May Also Like