Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

The global annual revenue for biopharmaceuticals has been growing consistently since 2001, accounting for 15.6% of the total pharmaceutical market in 2011. The global biopharmaceutical market was valued at US$138 billion in 2011 and is expected to surpass $320 billion by 2020 (1). The market for recombinant proteins now exceeds $100 billion, a milestone attained in 2011.

Figure 1: ()

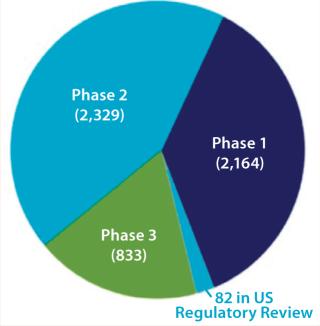

Much of the growth in biopharmaceutical revenue is due to an increasing number and sales of recombinant monoclonal antibodies (MAbs), now a $45 billion market — ~45% of the recombinant protein and ~31% of the overall biopharmaceutical market (2). Recombinant MAb sales will continue to increase rapidly in coming years as new products are approved. Many of the 5,408 medicines in development are in trials for more than one indication, so the total number of projects in development was close to 8,000 as of December 2011 (3). Figure 1 provides more detail.

Figure 1: ()

This rising prominence of biopharmaceuticals presents a big opportunity for contract manufacturing organizations (CMOs). The biopharmaceutical contract manufacturing market is expected to grow 7% per year, reaching $3.1 billion by 2016 (4). The main drivers for a biopharmaceutical client to outsource include

flexibility for expanding technical resources without increased overhead

efficient use of internal resources (focusing on core competencies and high-value projects while reducing or without adding infrastructure or technical staff)

potentially speeding new products to market

minimizing overall project costs.

Here we present a CMO perspective on structural and manufacturing complexities, quality challenges, regulatory concerns, and strategies for meeting the requirements of different global clients.

Structural and Manufacturing Complexities

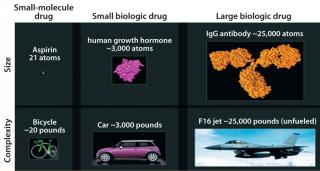

Biopharmaceuticals are drug products containing biotechnology-derived proteins as active substances. They structurally mimic molecules found in human bodies and are produced using advanced tools of genetic engineering. Having relatively higher molecular weight and complex three-dimensional (3-D) structures, their heterogeneity and production by living cells makes biologics different from classical chemical drugs. Figure 2 compares the structural complexities associated with biologics and small molecules.

Figure 2: ()

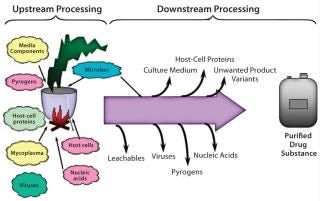

Biomanufacturing processes are also entirely different from classical drug manufacturing. Unit operations for small molecules are relatively simple, straightforward, controlled, and predictable. Biologics are recombinant proteins manufactured by living cells using several complicated and challenging upstream, downstream, and formulation processes. A great risk of structural differences in final product results can subsequently affect safety, efficacy, and (most important) possibly trigger adverse immune responses in patients. Figure 3 is a schematic representation of complexities associated with biomanufacturing.

Figure 3: ()

Quality Challenges

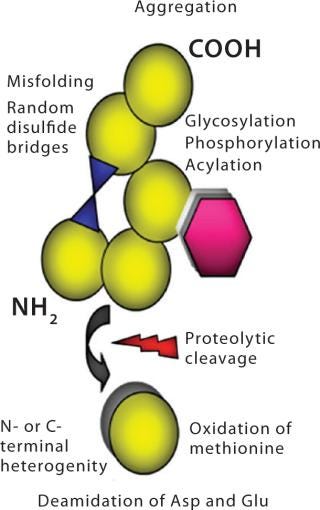

The large 3-D structure is not the only reason that biologics are complex molecules. Most have several structural “hot spots” where something can go wrong during upstream production, downstream processing, formulation, and subsequent storage. This presents potential risks to several quality attributes. Biologics are heterogeneous, naturally unstable, and easily damaged by mild stresses. Their function depends on a complex 3-D structure. Manufacturing them involves a large number of process-and product-related impurities (many immunogenic in nature), which aren’t always easy to discern from one another. Protein degradation pathways are not all clearly understood, and it is difficult to characterize all possible variants. The biological activity of these drugs must be verified in living systems. Figure 4 highlights some precursors for molecular-level structural heterogeneity in biologics.

Figure 4: ()

Many critical quality attributes (CQAs) can be addressed using advanced analytical tools. But some exceptions (e.g., immunogenicity) cannot be predicted through chemical or structural analyses of a biologic. Several factors are known to affect a product’s immunogenic potential: the presence

of impurities in a final product, structural modifications resulting from a manufacturing process, and storage conditions, for example. Analytical controls must be integrated into biomanufacturing processes to ensure the production of safe products with consistent quality. The risk of immunogenicity can be reduced through stringent testing of a biopharmaceutical during its development.

The technical issues become more complicated with biosimilars, especially when manufacturing is outsourced. An exact copy of a small-molecule pharmaceuticals can be synthesized and considered to be equivalent to the originator product if it has the same chemical structure, composition, and pharmacokinetic profile. With biologics, however, it is not that simple. Using a different manufacturing process, biosimilars manufacturers can produce a molecule that is “similar” but not identical to the originator product. Whether outsourced or not, a challenge for manufacturers of biosimilars is to demonstrate that their products are sufficiently like the originators in addition to showing consistent quality among different production runs from their own manufacturing facilities. Maintaining consistent product efficacy is also important to preventing overdosing of patients and concomitant risks of adverse events.

In addition to analytical challenges, a harmonized quality system is critical for CMOs. Biomanufacturing is technically complex and highly regulated by regulatory bodies worldwide. Even small deviations can have deleterious effects on a production process — and thus stability and efficacy of its end product. The main quality challenges involved when a sponsor works with CMOs around the world include technology acquisition and reproduction; maintaining quality standards complying with internal quality systems, regulatory requirements, and client expectations; managing process and product stability; and continuous improvement. Clients demand from CMOs the same level of quality and safety that the US Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regulatory agencies require of them. Regulatory bodies mandate that outsourced manufacturing be integrated into the operations of a sponsor organization, with quality audits conducted by sponsors at CMO sites.

Regulatory Concerns

A large number of candidate new biological entities (NBEs) in development and the increasing attention on biosimilars and biobetters presents a huge opportunity for CMOs. But some regulatory concerns must be addressed. Although regulatory pathways are well defined in some countries and being developed in others, the global industry has a long way to go toward harmonization of regulatory requirements, especially for biosimilars.

Use, quality, and availability of reference standards always poses a risk to the cost and timely launch of a biosimilar. Currently, innovator products (also known as reference medicinal products) are used as standards, but their use involves several administrative and technical issues. In addition to cost, they include lot variation, timely availability of different reference-standard lots, changes in innovator products while biosimilars are in development, and availability of material from different geographical regions (for comparability, preclinical, and clinical studies).

If biosimilars need to provide an affordable remedy to life-threatening diseases, then regulatory bodies should work toward establishing global reference standards. It would be helpful if regulatory agencies and pharmacopoeial authorities could provide some concise guidance on product characterization, process comparability, characterization of posttranslational modifications, and impurity profiling to ensure higher levels of harmonized compliance.

Strategies to Meet Different Global Requirements

Clearly the operational domain for biopharmaceuticals is significantly different from that of small molecules with respect to molecular complexities and analytics; chemistry, manufacturing/operations, and controls (CMC); business models and return on investment (RoI); and regulatory pathways. The business is even more complex for a biopharmaceutical CMO, which handles several products for a number of clients with different technical, regulatory, and quality prerequisites and expectations. To overcome all these challenges, a CMO needs to focus on flexibility in operations and analytics by using platform technologies, change management, analytical and process upgrading, and quality systems.

Flexibility in Operations and Analytics with Platform Technologies: Platform technologies are default sets of methods and conditions that can be universally applied to the manufacture and analytics of a given class of molecules and be expected to deliver product of predefined quality standards. Platforms include process tools and methods, hardware, and automation. While using these technologies, a CMO must maintain flexibility in operations and analytics to cater to the varied needs of multiple clients.

Much emphasis is being placed on platform technologies for modern biomanufacturing operations, especially involving certain expression systems, cell culture processes, purification processes, and formulations. Similar concepts are equally important and applicable to analytics. During planning and conceptualization of an analytical laboratory — particularly equipment selection — flexibility should be a goal to ensure that each analytical parameter can be analyzed using multiple, orthogonal techniques. For example, glycans can be profiled by capillary electrophoresis or analytical chromatography methods; and host-cell DNA can be analyzed by Southern blot analysis and polymerase chain reaction techniques.

Platform analytical technologies can facilitate timely acquisition and reproduction of technology from clients, which otherwise can pose a risk of significant project delays. Procurement of new analytical equipment to meet testing requirements can take a couple of weeks to months. After initial set up, platform technologies can be regularly updated with relevant new instruments, reagents, and methods. But CMOs need to cultivate a sound balance between capabilities and capital expenditures. With platform analytical technologies in place for higher-end characterizations, companies can build alliances with contract testing laboratories without compromising quality, compliance, and confidentiality.

Change Management: A proper change management structure helps CMOs deal with the uncertainties and complexities of biopharmaceutical contract manufacturing. A contingency plan of action should be in place to deal with scenarios such as a client’s inability to provide proper process know-how, issues during technology transfer, delays in project execution, unforeseen process and analytical changes, a requirement for more batches than were initially agreed upon, regulatory requirement changes, and so on. Careful evaluation will help determine the effects of such changes on project scope, cost, and schedule. A CMO also needs to account for how they will affect other projects.

Analytical and Process Upgrading: With some 8,000 biopharmaceutical candidates in different stages of development, quite a few new products are expected to be launched in the next five years. That presents a huge opportunity for biopharmaceutical CMOs. To realize the opportunity, it is important for them to build up strong technical competence for addressing global quality and CMC requirements.

Manufacturing aspects include strengthening quality in process development, extensive process characterization, quality by design (QbD), compliance with guidelines from the International Conference on Harmonisation of Technical Requirements for Registration of Pharmaceuticals for Human Use (ICH), formal CMC compliance systems, and means to address concerns about animal-derived components and viral safety. Analytical aspects include the suitability of each method for its intended use at different

stages of a product’s life cycle, advanced tools for structural characterization, the range of biological assays, detailed demonstrations of comparability with innovator products (for biosimilars), impurity identification and characterization, process and analytical method monitoring, statistical process control, comparability after process changes, and process analytical technologies (PATs).

Quality System: A biopharmaceutical CMO should have a flexible yet robust quality system in place to meet the quality requirements of different clients without compromising compliance. Processes (and thus quality) can differ between a client’s site and that of the CMO. A mutually agreed-upon quality agreement (QA) remains key to understanding a client’s quality requirements and managing the outsourcing relationship to ensure consistency in product quality, supply, and liability. The QA defines both the CMO’s and client’s needs as well as compliance requirements for the product and all pertinent regulatory commitments. It should be a “live” document that is reviewed and revised as needed to clarify responsibilities of both client and CMO as a product progresses through its life cycle.

Analytical tools can be part of a QbD program that spans the entire network. A common design space provides for a single approach to assessing criticality for all aspects of the process. A consistent QbD system provides benefits to both client and CMO. Primarily, it ensures continuous improvement in process and product understanding for a more robust commercial product. A QbD system can improve regulatory control in both the initial filing and postapproval phases of development. Additionally, it provides tools that allow clients to use QbD in manufacturing alongside traditional manufacturing. And finally, continuous improvement is achieved through regular, coordinated trending using data from all manufacturing sites.

Continuous training and development also should be in place at a CMO to ensure good regulatory compliance, technical knowledge, and general quality systems — with an emphasis on specific client requirements. Despite short-run product-cost impacts, minimum training hours should be defined in a quality system. Its effectiveness needs to be monitored regularly.

Harmonization of quality systems is another important aspect. Mere compliance with regulatory guidelines is not enough. Internal quality systems should be robust enough to fulfill client requirements in line with regulatory compliance. Challenges increase significantly with more clients, and the expectations of each client will be different and sometimes exceed regulatory requirements. That presents a challenge for a CMO’s quality team to ensure that client-specific requirements are built into its quality systems.

Project Management: Besides technical capabilities, strong project management is also required to manage expectations of various clients, keeping projects on track (adhering to timelines), budget, and facilitate decision making for successful project delivery. Timely approvals by clients for change controls, deviations, out-of-specification (OOS) results, and other key quality systems are a major challenge that can throw a project off-track. Both parties should agree on minimum times required for such processes and incorporate them into the QA process.

Quality By Intent

Rapid advances in the field of biopharmaceuticals and the promise it holds for providing safe, effective, and affordable healthcare present a big opportunity to CMOs. Quality challenges associated with that opportunity need to be addressed, however. If a CMO is to be successful over the long term, it must be able to harmonize and seamlessly integrate its quality systems with client expectation and regulatory requirements.

About the Author

Author Details

Deepak Gupta is associate director of quality control, GN Prashanth is vice president of quality, and corresponding author Sanjay Lodha is senior director of operations at Kemwell Biopharma Pvt. Ltd.,34th KM,Tumkur Road, T-Begur, Nelamangala, Bangalore Rural-562123, Bangalore, India; 91-80-39285106;www.kemwellbiopharma.com.

1.) Press Release 2012. Global Biopharmaceutical Market Expected to Reach $320 Billion by 2020, Global Information Inc., Kawasaki.

2.) Langer, ES. 2012.9th Annual Report and Survey of Biopharmaceutical Manufacturers, BioPlan Associates, Rockville.

3.) 2013. The Biopharmaceutical Pipeline: Evolving Science, Hope for Patients, PhRMA, Washington.

4.) Downey, W 2012.Bio-CMO Industry Trends: Recent Initiatives in Biopharma Contract Manufacturing, Contract Pharma.

You May Also Like