Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

May 1, 2011

The biopharmaceutical market accounts for about 20% of the total market for pharmaceuticals, but its share continues to increase because of double-digit compound annual growth rates leading to projections that by 2014 eight of the top 10 best-selling drugs will be biologics (1). The industry faces many challenges and opportunities, as Jim Davies of Lonza Biologics explained to me:

“Biomanufacturers have to contend with what is at present a dynamic technical and commercial landscape. Industry consolidation continues to occur as large pharmaceutical companies look to small biotechs to strengthen their product pipelines. Production of biologics has become a global enterprise, with new manufacturing hubs such as Singapore and South Korea developing in the Asia–Pacific region. There is a lot of interest in the biosimilars market at the moment, for which the cost of goods is likely to play a more significant role in commercial success relative to innovator molecules. Adoption of single-use processing technology and systems is now widespread, allowing rapid turn-around times between batches and increasingly flexible process configurations. The issue of bottlenecks created in downstream processing as a consequence of higher bioreactor titers is well documented. Available technologies such as disposables, single-pass TFF [tangential-flow filtration], high-performance TFF, and flow-through cation-exchange membrane adsorbers can solve some of these problems without recourse for radical process redesign or expensive retrofitting of existing manufacturing facilities.”

PRODUCT FOCUS: BIOLOGICS

PROCESS Focus: DOWNSTREAM pROCESSING

WHO SHOULD READ: PROCESS DEVELOPMENT, MANUFACTURING, OPERATIONS MANAGEMENT

KEYWORDS: FILTRATION, COST OF GOODS (CoG), PROCESS OPTIMIZATION, DECISION MATRICES, PROCESS CHANGES

LEVEL: BASIC

Technological innovations such as those Davies mentioned could dramatically improve facility throughput; however, the battle to control costs and improve efficiencies in biopharmaceutical production can be fought on many fronts. Productivity initiatives increase cash flow, reduce the cost of medicines, and allow reinvestment into product pipelines. Process intensification can be achieved by adopting lean principles and optimizing process configurations to maximize the performance of existing, validated processes (2). Selection of suppliers with the means and expertise to work in partnership with biomanufacturers to improve productivity and realize cost savings remains a key focus among customers. The maximum benefits of supply base optimization are observed in organizations comprising multiple divisions in which procurement practices have not yet been integrated.

NORMAL-FLOW FILTRATION SUPPLIERS FOR BIOPROCESSING

3M Purification

Asahi Kasei TechniKrom

GE Healthcare

Pall Corporation

Parker domnick hunter Process Filtration

Meissner Filtration Products

Merck Millipore

Sartorius Stedim Biotech SA

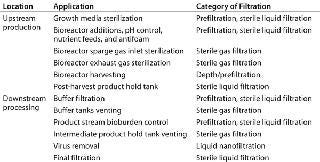

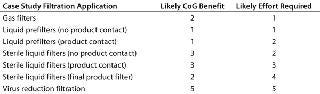

Recent cost modeling of a 2,000-L stainless steel biomanufacturing process has determined the cost of goods (CoG) proportion derived from filtration to be in the range of 7–10% (3). Normal-flow filtration is ubiquitous in bioprocessing for clarification, control of bioburden, and virus removal. Table 1 lists some examples of such applications.

Table 1: Normal-flow filtration applications in the biopharmaceutical industry

The biopharmaceutical filtration market is dominated by a small number of well-known suppliers (see the “Suppliers” box). These companies have diversified their offering and now provide their customers with processing technologies to apply throughout their manufacturing facilities, from bioreactors to chromatography solutions. Emerging suppliers to the biopharmaceutical industry usually focus on either filtration core competencies or niche applications such as virus-reduction filtration.

Research performed on procurement practices across diverse industries is yielding increasingly sophisticated models for supplier selection. A generalized selection hierarchy has previously been published (4). My company adapted that to the biopharmaceutical industry based on experience with customers (Figure 1).

The structure of this framework retains the original format that breaks the supplier-selection problem into a four-tier hierarchy. The top tier represents the ultimate goal (a selected supplier), the second tier represents six main selection criteria, the third represents subcriteria, and the final tier represents suppliers being assessed against those subcriteria. Each criterion is weighted based on assessments of its relative importance to members of the procuring organization. Suppliers can be scored for each criterion and their overall scores calculated with those weightings taken into account.

Weightings allocated will vary among biomanufacturers depending on the nature of their operations. Multinational companies operating licensed processes on different continents will consider global supply and support criteria to be more important. A start-up company operating a single facility for products in early clinical phases will give greater weighting to the ability to provide technical support for scale-up and validation activities.

The six main selection categories my company defined for this framework are business criteria, quality systems, technical support, manufac

turing capabilities, human resources, and information technology. The ability of a vendor to supply filters in the required volume clearly depends on its manufacturing facilities and personnel supporting those operations. Strategic deployment of information technology (IT) can make a manufacturer easy to do business with and its products easy to use.

Business criteria — e.g., reputation, technology availability, and price — play significant roles in supplier selection for the biopharmaceutical industry. However, quality criteria are prerequisites for commencement of supply agreements between biomanufacturers and their suppliers. Filter manufacturers produce documentation to support their products by detailing methods used to make them and results of physical, chemical, biological, functional, and sterilization tests. Facility audits allow biomanufacturers to assess the suitability of supplier quality systems and associated documentation. Among procedures evaluated during such audits are a filtration manufacturer’s ability to ensure the quality of raw materials provided by its own suppliers, a validated filter manufacturing process, and the controlled release of filter products.

The listed criteria are all pieces in the procurement puzzle, but it is clear that biopharmaceutical manufacturers greatly value suppliers that can provide a high level of technical support. Those excelling in this field play an important role in ensuring continued and smooth operation of biopharmaceutical production processes. Piranavan Thillaivinayagalingam of Novartis Pharma SAS highlighted this when asked about his experience working with filtration companies:

“The most effective filtration suppliers are willing and able to come on site and assist with process optimization or to troubleshoot problems by setting up and running experiments themselves. What is of critical importance is that a supplier understands the urgency with which biomanufacturers frequently need issues resolved. Delays can be incurred if suppliers fail to react quickly enough. That can run to many weeks and delay batch releases, which can in turn impact supply of product to the clinic.”

Filtration suppliers’ technical support groups have become an important resource for biopharmaceutical manufacturers in improving process efficiencies, which critically leads to improved business performance through cost savings. John Yannone, a process engineer for MedImmune, described to me the benefits of collaborations with vendors:

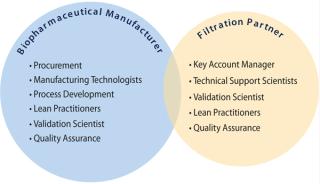

“We worked closely with a vendor on a project to optimize our virus filtration step. We provided process data and assumptions that we were comfortable with, and they were able to model the process and propose an optimized solution. The information the company provided about the cost of implementation and likely benefits justified that project internally to mutual benefit.” Our experience at Parker domnick hunter Process Filtration has been that maximum customer benefits are achieved when suppliers and biomanufacturers work together in partnership as part of a cross-functional and multidisciplinary team (Figure 2).

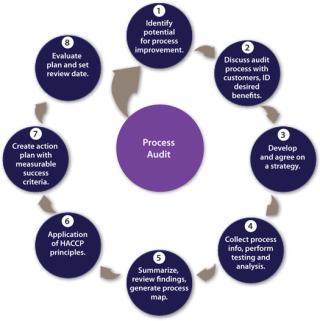

The role of process audits by filtration partners has been highlighted previously and are typically provided free of charge (5). Once a team has been established, then a structured, multistage approach can be adopted for a process audit with defined objectives and a strategy for data collection agreed and executed. Findings reviewed will lead to an action plan with measurable success criteria. A review date should be set to assess progress and define future activities in accordance with the principles of continuous improvement (Figure 3).

Case Study

This case study illustrates the importance of a suppliers’ technical support capabilities. By working in partnership, a biomanufacturer and vendor were able to identify opportunities to minimize production costs in a purification process for a therapeutic monoclonal antibody. Normal-flow filtration use was analyzed for a large-scale purification process used. The process is typical for an antibody product: three chromatography columns, ultra filtration, virus filtration, and virus inactivation steps. The scope of this project did not include primary recovery of product from a cell culture bioreactor. Process equipment is predominantly stainless steel, with some limited use of single-use bioprocess containers. All liquid filters were changed between batches; however, gas filters can be reused more often (which was not considered in this summary)

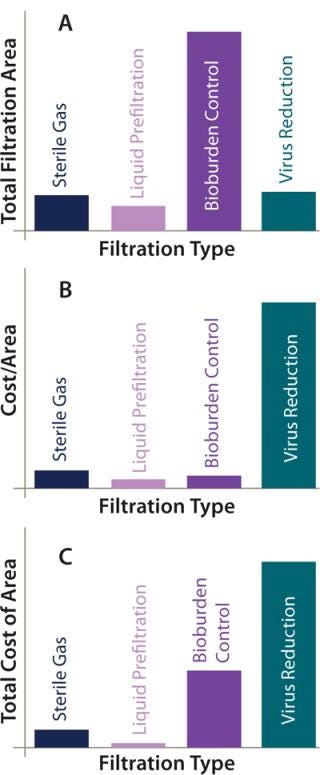

Figure 4A overviews the filtration analysis used in production of an antibody product batch, showing the greatest filtration use to be that of membrane filters for controlling bioburden throughout the process. In this case, they are sterilizing-grade filters used to filter buffers and intermediately purified product. About the same area of virus reduction filtration and gas filtration is used within the process. We might consider that less gas filtration would be present in processes that make greater use of single-use technology, where venting is less of a requirement. This purification process made some limited use of prefiltration for removing precipitation following the virus inactivation step and before sterile filtration.

Figure 4B illustrates the relative cost of each type of filter by unit area. Unsurprisingly, virus-reduction filters are by far the most expensive, given the critical role they play in ensuring patient safety. When the total cost of filtration area per batch is considered, the greatest contribution comes from those filters, but the large area of sterilizing-grade filters makes their cost contribution more significant. Gas filters and liquid prefilters contribute least to the overall costs (Figure 4C).

The degree of effort required to optim

ize each filtration type varies considerably. Making changes to a virus filtration step carries a high degree of risk, and extensive validation studies will be required. Clearly that needs to be factored into the cost of making a change. The ease with which changes can be made to liquid prefiltration and bioburden-control applications depends on their location within a process and whether they come into contact with the product. For each application within a process, the likely benefit of optimization on CoG and efforts required were scored from 1 to 5, with 5 being the highest score (Table 2).

Table 2: Benefit/effort scores for optimizing filtration processes in an antibody purification process

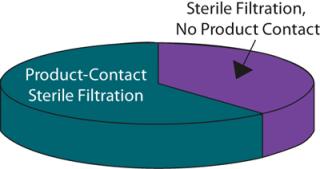

Wherever the score for changing a process was greater than that for the benefit received, a change was discounted. For example, changing the final product filter would have little effect on the process CoG but would require considerable validation effort because it is the last operation performed on a product before filling and thus plays a critical role in ensuring sterility and safety of the final product. Applications for which the benefit score was equal or greater than that for changing were considered in greater detail. Analysis showed that of the remaining sterilizing-grade filters, some 60% were product-contact filters used to sterilize intermediate product pools and about 40% were non–product-contact filters used to filter purification buffers before storage (Figure 5).

By adopting a structured process audit approach, the company identified that buffer filtration applications represent an excellent target for optimization because of the likely savings that could be achieved with the effort invested. Optimization of such applications could include ensuring that the correct filtration technology is being used, that it is appropriately sized, and that the capacity is maximized. Reuse is implemented wherever applicable, and buffer sterilization is eliminated wherever it is not required. Once opportunities like these are identified, a filtration partner should be able to perform the required testing and then develop and execute appropriate validation protocols to facilitate implementation of the process change.

In this way, the role of a filtration supplier’s technical support team in identifying and implementing process improvements to maximizing customers’ process efficiencies — and thereby assisting them in achieving their business objectives — can be clearly demonstrated. This explains the high weighting the technical-support criterion is given when biomanufacturers select their filtration partners.

A Collaborative Future

As biopharmaceutical companies continue to adapt to a changing technological and financial environment, they can maximize process efficiencies and reduce costs by carefully selecting their suppliers based on a range of diverse criteria. Among those criteria, the level of technical support that suppliers can provide is becoming increasingly important. Mike Brailsford, general manager of Parker domnick hunter Process Filtration puts it this way:

“Customers are increasingly globalized and expect their filtration suppliers to be able to support them at multiple international locations. However, it is increasingly clear that the support required extends far beyond the supply of filtration products as customers look to their suppliers to partner with them to ensure that they get the most out of their processes. Filtration partners need to fully understand their customers’ core business and help them achieve their goals by providing a targeted audit process to identify process improvements and cost savings, new product and technology opportunities, and ongoing support through expert teams for troubleshooting, training, and process improvement. The future will certainly see a continued extension of the partnership between suppliers and their customers.”

About the Author

Author Details

Nick Hutchinson is market development manager at Parker domnick hunter Process Filtration, Durham Road, Birtley, County Durham DH3 2SF, England; +44-191-4105121, fax 44-191-4105321; [email protected].

1.) 2000.World Preview 2014, EvaluatePharma, London.

2.) Stonier, A.. 2009.Dynamic Simulation Framework for Design of Lean Biopharmaceutical Manufacturing Operations 19th European Symposium on Computer Aided Process Engineering (ESCAPE19), Elsevier BV, Amsterdam.

3.) Sinclair, A. 2010. How Geography Affects the Cost of Biomanufacturing. BioProcess Int. 8:S16-S19.

4.) Sevkli, M.. 2008. Hybrid Analytical Hierarchy Process Model for Supplier Selection. Ind. Management Data Syst. 108.

5.) Maynard, J. 2009. Supplier Innovation Is an Imperative. BioProcess Int. 7:S68-S71.

You May Also Like