Voices of Biotech

Podcast: MilliporeSigma says education vital to creating unbreakable chain for sustainability

MilliporeSigma discusses the importance of people, education, and the benefits of embracing discomfort to bolster sustainability efforts.

June 1, 2011

France Biotech (the French association of life-science companies) presented the results of its “Life Science Panorama 2010” survey at the BioVision world life-sciences forum in Lyons, France, on 29 March 2011. The survey describes major trends for 2009–2010 in the life-science industry, both in France and internationally. More than 263 companies responded to the survey this year, and 211 were included in the final analysis.

Main Trends in France

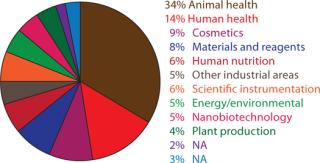

Results of the latest survey attest to the arrival of “second-generation” biotech companies to France. Even though a high proportion of companies (48%) work in human or animal health, new companies are emerging in the French medical technology, environmental, and renewable energy sectors. The French government is encouraging creation of such business through its “biotech and bioresources” call for projects under a national bond scheme called Grand Emprunt.

Most French life-science companies are located in one of three regions: the Paris Ile de France region (33%), the Rhône-Alpes region (16.6%), and the Provence-Alpes-Côte d’Azur (PACA) region (10.5%). The mean number of staff on their payrolls was 25 in 2010 (it was 19 in 2009). The study shows that the French biotechnology industry has weathered the global financial crisis well. A third of all companies were incorporated at least 10 years ago (including Vivalis, Integragen, and Novagali Pharma) compared with just 18% last year. The proportion of incorporated businesses has fallen, however: 15% of companies under three years old in 2011, 20% in 2009.

Scientists study cell clones in a laboratory at Cellectis near Paris. ()

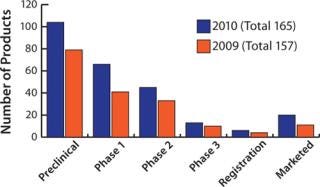

French life-science product pipelines are encouraging, considering the weight of the pharmaceutical industry. Oncology and infectious disease are the most favored therapeutic and diagnostic fields. Research and development (R&D) is concentrated on the products for human health care, with two-thirds of companies stating that they have at least one therapeutic product in development or on market.

Although mergers and acquisitions are generally the preserve of multinational corporations, the French stock-listed companies Cellectis and Vivalis each made two acquisitions in 2010. The Panorama data suggest that other acquisitions are on the way. An attractive tie-up between Actelion and Trophos was signed in July 2010. The latter company has attracted significant international interest in its Olesoxime drug candidate, which is currently in phase 3 clinical trials. Vivalis was again the most active French company in terms of corporate alliances with the overall pharmaceutical industry.

Twelve companies went out of business in 2010, and it was clear that some corporate alliances probably took place as a result of financial problems. Even though 2010 was a remarkable year in terms of fundraising, fully a third of all companies encountered financial difficulties: 20% had cash-flow problems, 27% needed to raise funds, 7% made staff redundant in 2010, 5% will have to make staff redundant in 2011, and 4% are going to file for legal protection from creditors.

Figure 1: ()

Figure 2: ()

Corporate Fundraising

State Funding: In 2010, 114 companies (out of 181 responders) had Young Innovative Company (Y IC) status, which provides French companies under eight years old with a number of tax breaks. In 2010, these fiscal incentives leveraged the hiring of 394 R&D personnel (an average of three per company), the launch of R&D projects worth €44 million, and investment in equipment worth €2.2 million. Those figures clearly demonstrate the effect that YIC status has had in strengthening R& D at French biotechnology companies. Recently incorporated life-science small-to-medium size enterprises (SMEs) are now asking for YIC status at an early stage.

According to another France Biotech survey conducted in October 2010, the French research tax credit scheme (affecting 1,227 people) benefited 27 companies with up to 10 employees, 15 companies with 11–30 staff, and 16 companies with more than 30. The total eligible R& D expenditure in 2009 was €167 million, with a deduction of €10 million in repayable advances. A total of 870 researchers were considered. On average, R&D-associated expenditures by these companies corresponded to 280% of their research staff costs.

Although new government initiatives (such as the French National Bond Scheme and the Strategic Innovation Fund) are now in place, too many French companies continue to have enormous difficulties in accessing funds.

Venture Capital Financing: 2010 was an exceptional year for financing of innovation through venture capital (VC). Following a 65% drop in 2009, the total amount of such capital raised by life-sciences companies increased by 56% in 2010 (from €65 million to €148 million). The total amount invested in seed-capital funding and first-round financing fell by 10% to €20 million, although the average ticket increased by 83% to €6 million. The number of first-round financing transactions fell from 17 in 2009 to just six in 2010. However, the proportion of seed-capital investment and first-round financing dropped from 15% of total fundraising in 2009 to 14% in 2010. There were 21 second-round and other transactions, with tickets ranging between €37 million and €144 million.

Listed Biotech Companies: The Euronext Next Biotech index was created in April 2008 to track the performance of listed biotechnology companies across Europe. At present, the index features 34 companies, of which 12 are French: Cellectis, ExonHit Therapeutics, Genfit, GenOway, Hybrigenics, Innate Pharma, Ipsogen, Transgene, Vivalis, Neovacs, IntegraGen, and AB Science. Other French

life-science companies are listed on a number of markets: BioAlliance Pharma and NicOx on Euronext, Cerep on Alternext, and Flamel Technologies on Nasdaq.

Financial Support for Innovation in 2011

VC is the defining source of funding for life-science companies, it can’t meet the sector’s needs alone. Stock-market listings rose in 2010, with seven of the 10 European IPOs for French companies. It was an exceptional year for the stock market, which had not seen any sector listings since 2008 (Ipsogen being the only company to have made such a move since then).

Oséo and FSI: The French state innovation agency known as Oséo invested a total of €42 million in 344 projects. The proportion of pharmaceutical–biotechnology projects in its innovation support budget remained stable at 10%. In 2010, Oséo’s Strategic Industrial Innovation program awarded €58 million in financial support to six such projects (45% of the total number of projects).

The €2 billion Fonds Stratégique d’Investissement program for SMEs (FSI-PME) was set up in October 2009. It is jointly managed by Oséo and the national Strategic Investment Fund (FSI). As part of the FSI-France Investissement program, the FSI also set up two VC mutual funds in late 2009. They are managed by CDC Entreprises (the FSI’s operator for privately held SMEs) and a number of partners.

Figure 3: ()

The InnoBio Fund was created in late 2009 to focus on innovative life-sciences companies. It has access to €139 million from the FSI and a number of pharmaceutical companies (Sanofi-Aventis, GSK, Roche, Novartis, Pfizer, Lilly, Ipsen, Takeda, and Boehringer-Ingelheim). Six investments have been made so far.

The Kurma Biofund run by CDC Entreprises and Natixis Private Equity has a Europe-wide life-science focus. This €50-million fund made its first two investments in late 2010, €1.1 million in Indigix (United Kingdom) and €1.2 million in Meiogenix (France). It has since invested in three other start-ups: Sterispine and PathoQuest in France and Key Neuroscience in the United Kingdom.

Major Global Trends

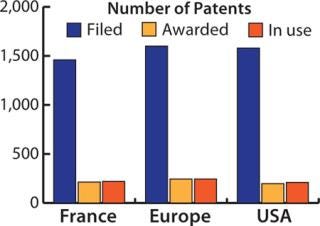

According to a 2010 industry survey by IMS Health, the global pharmaceutical market will be worth around US$975 billion by 2013. However, the sector’s recent double-digit growth is expected to slow markedly. The main limiting factor relates to blockbuster drugs, which are going off-patent and becoming exposed to competition from generics and biosimilars. This industry must now deal with the loss of its core patents, uncertainty concerning new drug development, and taking products through to market (the cost of which is constantly rising) under increasingly stringent regulations. Because of a drought of other innovation, biotechnology now accounts for about 70% of newly registered drugs. The “big pharma” model has had its day, and much attention is now focusing on the life sciences through collaborations, licensing agreements, and acquisitions.

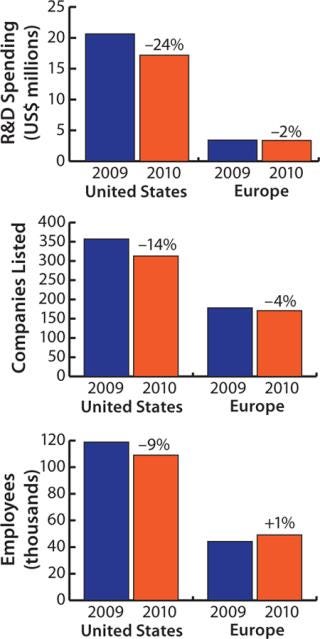

In 2009, the total turnover for stock-listed life-science companies amounted to nearly $90 billion, a 12% increase since 2007. However, the situation differs across geographical regions. The United States has conserved its leadership with 74% of the global market. It is followed by Europe (with 18%) and the Asia–Pacific zone (with 5.5%).Although Europe and America have about the same number of biotechnology companies, the American businesses are much more mature. They spend an average of five times more on R&D and have twice as many employees.

Figure 4: ()

Based on turnover for 2009, six of the 10 biggest companies were American — except for the large Australian life-science company CSL Limited and Swiss company Actelion. The US life-science sector became profitable as a whole for the first time recently, with net profits of $417 million and $370 million in 2008. Even though those figures are strongly influenced by the US “big biotech” companies, it nevertheless constitutes an encouraging sign for the whole industry.

Figure 5: ()

Although Europe’s biotechnology sector is younger than its US counterpart, stock-listed European companies saw their revenues grow by 26%, according to the latest survey results. A few European companies are now mature enough to pull the sector along. In 2009, the region’s biotechnology sector posted a net loss of $288 billion compared with its net loss of $913 billion in 2008.

Figure 6: ()

The Asia–Pacific zone has also emerged as a player in the life-sciences market over the past few years, mainly following in Australia’s wake. Most notably due to CSL Limited, the sector grew by 25% in 2008. Even though life-science businesses in China and India have not yet made major breakthroughs, both countries are standing on the threshold and have enough assets to muscle their way into global markets.

Fundraising

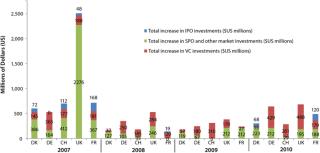

In 2007, 326 life-science companies raised a total of $6.8 billion in venture capital. The same figure fell successively by 7% in 2008 and another 8% in 2009 (down 14% over two years) — but it rose b

y 5% for 2010, with 318 businesses attracting a total of $5.4 billion in VC funding.

Initial Public Offerings (IPOs): The United States stood out from the rest of the world with 18 IPOs in 2010 (totaling $1,283 million). In Europe, $230 million was raised by nine IPOs: eight in France (Neovacs, Deinove, AB Science, IntegraGen, Stentys, Carmat, and Novagali Pharma) and one in Denmark (Zealand Pharma). The latter company took the year’s European record by raising $68 million. The two French companies raising the most capital in their IPOs were Stentys (€22.7 million) and Novagali Pharma (€ 22 million), which places them respectively at 17th and 19th places in the global top-20 ranking of IPOs. In 2010, the Asia–Pacific zone posted four IPOs totaling $98 million, one more than in 2009 (when three IPOs raised $65 million).

Mergers and Acquisitions: The global annual volume of M&A operations grew significantly during 2008 and 2009. From a figure of ~$50 billion in 2007, the total rose to $55 billion in 2008 and $67 billion in 2009. The average deal value also increased each year: from $216 million in 2007 to $670 million in 2009. Europe topped the M&A rankings in 2010 with Novartis’s acquisition of Alcon ($41 million), followed by Teva and Sanofi.

Corporate alliances have never been as hot as they were during the past two crisis years. The number of alliances nearly doubled between 2005 and 2009, and their cumulative annual value rose by 157% to just over $41 billion.

About France Biotech

France Biotech is the French association of life-science companies and their partners. Its mission is to support the industry’s grow thin France by lobbying for a favorable fiscal and legal environment. When the YIC fiscal status was introduced under the country’s 2004 budget bill, France Biotech lobbied for this innovative sector to be considered as an industry in its own right. The organization has >150 members and 17 business leaders on its boa rd of directors.

Since 2002, France Biotech has carried out its Life Sciences Panorama, the only annual survey of the life-science sector in France. The organization uses these study results to analyze the market outlook for its corporate members, make recommendations for improvements, and distinguish the industry as a sector in its own right. Survey data are provided by independent companies that spend >15% of their revenues on R&D. France Biotech contacted more than 450 companies and analyzed the complete results of secure online questionnaires provided by 211 responders (out of 263 replies).

The Life Sciences Sector in France: It is safe to say that we are now embarking on the second generation of life-science companies in France — after the first generation that began with the creation of Transgene. At present, the country is home to ~250 life-science companies in five main business sectors: primarily therapeutics, closely followed by diagnostics, innovative medical devices and two new entries, cosmetics and the environment.

The 2010 survey results show that the life-science industry in France has never been so lively — partly thanks to support from the French government. French companies are pursuing first-rate development projects, and the sector’s future is promising. Nevertheless, France Biotech has warned the nation’s government about the negative impact of some reforms set out in its 2011 budget bill — in particular, progressive eradication of the YIC fiscal status. This move will threaten survival of many companies. France Biotech will continue to lobby the government to backtrack on these recent legislative changes.

About the Author

Author Details

André Choulika, PhD, is CEO and founder of Cellectis, a genome engineering company founded in 2000, 102 Route de Noisy, 93235 Romainville, France; 33-141-83-99-00; www.cellectis.com. He is also chairman of France Biotech (www.france-biotech.org).

You May Also Like